CAPITAL & Regional, the UK shopping centre owner, achieved a 228% increase in its total dividend declared for last year, off the back of rental growth and a strengthening consumer.

The company took up a secondary listing on the JSE in October last year, offering South Africans exposure to Western European-listed property.

The group declared a dividend of 3.12p per share compared with its 2014 financial year, where a 0.95p per share dividend was declared.

Capital & Regional specialises in dominant community retail and leisure centres in towns in the UK and has brought a portfolio valued at about £11bn to the JSE.

The company owns seven shopping centres in Blackburn, Camberley, Hemel Hempstead, Luton, Maidstone, Walthamstow and Wood Green.

It also has a 20% joint venture interest in the Kingfisher Centre in Redditch and a 50% joint venture in the Buttermarket Centre, Ipswich.

Capital & Regional manages these assets, which include more than 950 retail units and attract more than 1.7-million shopping visits each week, through its in-house property and asset-management platform.

The group reported in its financial results for the year to December, that its operating profit had increased 24% to £24m for the period, compared with £19.3m for the previous year.

Total profit of £100m was earned during the reporting period, compared with £75.2m for the 2014 year.

The group’s net asset value per share increased 20% to 72p.

"Operationally, this has been an important year for Capital & Regional. We have consolidated and grown our portfolio through progress on the delivery of the capital expenditure programme, and our entrepreneurial approach to acquisitions has enabled us to further showcase the depth of our asset management capabilities," CEO Hugh Scott-Barrett said.

"Our centres are trading profitably, benefiting from a range of high-profile tenants and an increasing leisure offer, which accounted for 40% of new lettings in 2015," he said.

Mr Scott-Barrett said that the UK consumer had also strengthened and was enjoying more disposable income.

"Reflecting our confidence in these growth prospects, the board is targeting future dividend growth in the range of 5% to 8% per annum in the medium term," said chairman John Clare.

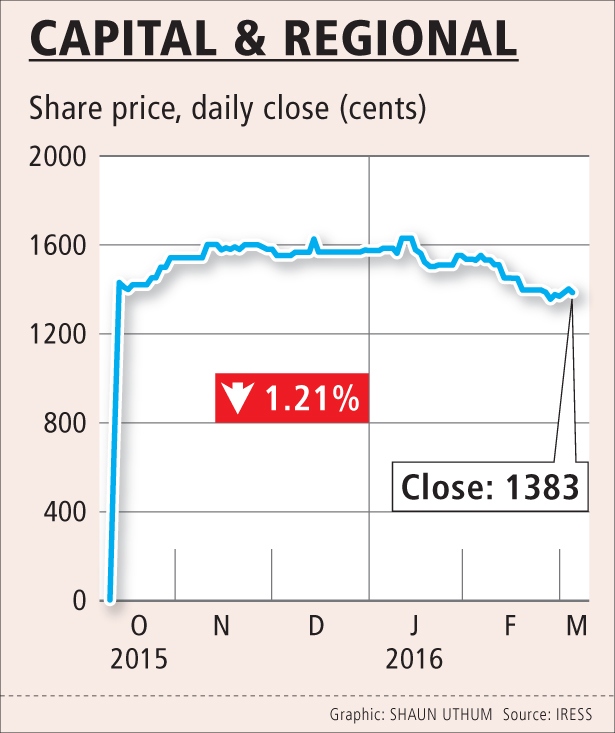

Year to date, Capital & Regional’s share price has lost nearly 11%.

More UK and European property funds are expected to seek listings on the JSE in the near future as they look to benefit from South African investors’ appetite for rand hedge stocks in a slowing, weak rand economy.

Picture: THINKSTOCK

CAPITAL & Regional, the UK shopping centre owner, achieved a 228% increase in its total dividend declared for last year, off the back of rental growth and a strengthening consumer.

The company took up a secondary listing on the JSE in October last year, offering South Africans exposure to Western European-listed property.

The group declared a dividend of 3.12p per share compared with its 2014 financial year, where a 0.95p per share dividend was declared.

Capital & Regional specialises in dominant community retail and leisure centres in towns in the UK and has brought a portfolio valued at about £11bn to the JSE.

The company owns seven shopping centres in Blackburn, Camberley, Hemel Hempstead, Luton, Maidstone, Walthamstow and Wood Green.

It also has a 20% joint venture interest in the Kingfisher Centre in Redditch and a 50% joint venture in the Buttermarket Centre, Ipswich.

Capital & Regional manages these assets, which include more than 950 retail units and attract more than 1.7-million shopping visits each week, through its in-house property and asset-management platform.

The group reported in its financial results for the year to December, that its operating profit had increased 24% to £24m for the period, compared with £19.3m for the previous year.

Total profit of £100m was earned during the reporting period, compared with £75.2m for the 2014 year.

The group’s net asset value per share increased 20% to 72p.

"Operationally, this has been an important year for Capital & Regional. We have consolidated and grown our portfolio through progress on the delivery of the capital expenditure programme, and our entrepreneurial approach to acquisitions has enabled us to further showcase the depth of our asset management capabilities," CEO Hugh Scott-Barrett said.

"Our centres are trading profitably, benefiting from a range of high-profile tenants and an increasing leisure offer, which accounted for 40% of new lettings in 2015," he said.

Mr Scott-Barrett said that the UK consumer had also strengthened and was enjoying more disposable income.

"Reflecting our confidence in these growth prospects, the board is targeting future dividend growth in the range of 5% to 8% per annum in the medium term," said chairman John Clare.

Year to date, Capital & Regional’s share price has lost nearly 11%.

More UK and European property funds are expected to seek listings on the JSE in the near future as they look to benefit from South African investors’ appetite for rand hedge stocks in a slowing, weak rand economy.

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.26%

Change: -0.04%

Change: -0.14%

Change: -0.29%

Change: -0.23%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data