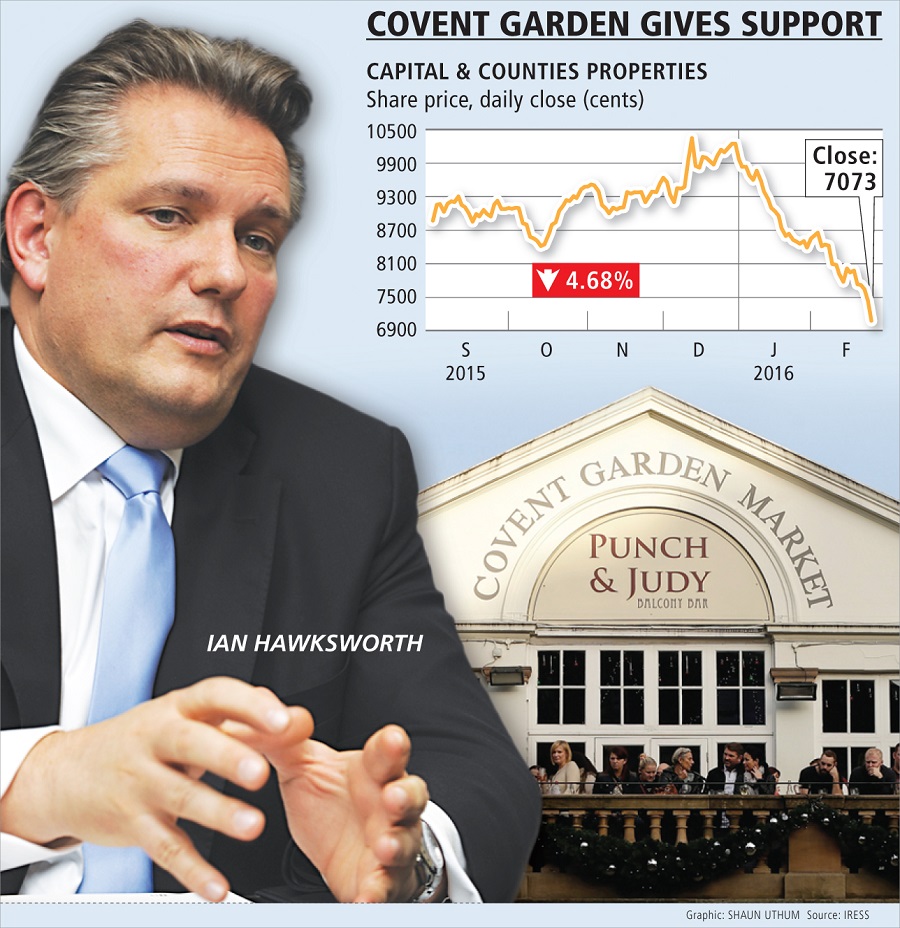

CAPITAL and Counties (Capco), the UK-based owner of London’s Earls Court and Covent Garden, has lost momentum, with its share price having weakened considerably after initial strong growth last year.

But analysts believe the company’s shares offer value at existing price levels, as its core assets offer solid, long-term returns.

Shares in the company, which released annual results for the year to December yesterday, have fallen more than 20% since the beginning of October, with its Earls Court lifestyle estate losing business in a slowing London residential market.

Fears of Britain exiting the eurozone (Brexit) have also brought pressure to bear on the British real estate sector.

The company’s new residential development, Lillie Square in Earls Court, which will contain 808 flats, also came under pressure. A slowdown in the prime central London market led to Capco reserving or exchanging only 40%, about 30 flats, in the five months of a phase two sales rollout, compared with 200 having been reserved or exchanged in the first five weeks of phase one.

Nevertheless, Capco achieved a 17% total return for the year, thanks largely to a strong performance by the company’s Covent Garden shopping precinct.

The company’s total property value rose 14% like for like, from £3bn to £3.7bn.

A final 2015 dividend of 1.0p per share was declared, providing a full-year dividend of 1.5p per share.

"These results demonstrate another strong year of performance at Capco, particularly at Covent Garden," CE Ian Hawksworth said.

"Retailer demand for prime locations in London is positive, and brands are attracted to the retail and customer experience we have created at Covent Garden," he said.

"It has been our most active year of leasing, signing our 100th brand, a milestone which reflects the transformation of the estate and Covent Garden’s increasing importance in global ‘street’ retail. We achieved new rental levels in 2015, and remain on course to achieve our estimated rental value target of £100m by December 2017."

Investec Asset Management portfolio manager Peter Clark said Capco’s 2015 had been soured by pressure on London’s residential market and negative sentiment about what would happen to the UK economy if Britain left the eurozone.

"It was a mixed bag of results for Capco. On the bear side, the slowing London residential market was evident, as sales at Lillie Square came to a standstill in the last quarter.

"The negative sentiment and share price weakness has primarily been on concerns around the London residential market and Brexit, which appears to be more than priced in, and the share now offers attractive value for investors," Mr Clark said.

Long-term prospects were positive. "The Earls Court valuation continued to tick up, albeit at a slower pace to reflect progress with planning permission. The long-term story remains intact, and will get a boost from an increase in density on the site, as well as the recognition of the land parcel, where Capco have exercised an option to acquire.

"On the bullish side, Covent Garden continues to perform well, setting record rents and record leasing levels, which delivered market rental growth of 12% for the estate, and are comfortably on track to deliver rental targets in 2017," Mr Clark said.

Maurice Shapiro, fund manager at Ma’alot Investments, said Capco’s active management of Covent Garden had boosted the group and its overall net asset value.

"Management continue to actively property manage Covent Garden, with impressive leasing ... with top brands such as Chanel. Similarly, management have continued with good development progress in Earls Court. Net asset value growth was strong, with a 16% uplift a share to a net asset value of £3.61. The share is currently trading well below net asset value, both on the JSE and London Stock Exchange."

It has been our most active year of leasing … a milestone that reflects Covent Garden’s importance in global ‘street’ retail

Picture: THINKSTOCK

CAPITAL and Counties (Capco), the UK-based owner of London’s Earls Court and Covent Garden, has lost momentum, with its share price having weakened considerably after initial strong growth last year.

But analysts believe the company’s shares offer value at existing price levels, as its core assets offer solid, long-term returns.

Shares in the company, which released annual results for the year to December yesterday, have fallen more than 20% since the beginning of October, with its Earls Court lifestyle estate losing business in a slowing London residential market.

Fears of Britain exiting the eurozone (Brexit) have also brought pressure to bear on the British real estate sector.

The company’s new residential development, Lillie Square in Earls Court, which will contain 808 flats, also came under pressure. A slowdown in the prime central London market led to Capco reserving or exchanging only 40%, about 30 flats, in the five months of a phase two sales rollout, compared with 200 having been reserved or exchanged in the first five weeks of phase one.

Nevertheless, Capco achieved a 17% total return for the year, thanks largely to a strong performance by the company’s Covent Garden shopping precinct.

The company’s total property value rose 14% like for like, from £3bn to £3.7bn.

A final 2015 dividend of 1.0p per share was declared, providing a full-year dividend of 1.5p per share.

"These results demonstrate another strong year of performance at Capco, particularly at Covent Garden," CE Ian Hawksworth said.

"Retailer demand for prime locations in London is positive, and brands are attracted to the retail and customer experience we have created at Covent Garden," he said.

"It has been our most active year of leasing, signing our 100th brand, a milestone which reflects the transformation of the estate and Covent Garden’s increasing importance in global ‘street’ retail. We achieved new rental levels in 2015, and remain on course to achieve our estimated rental value target of £100m by December 2017."

Investec Asset Management portfolio manager Peter Clark said Capco’s 2015 had been soured by pressure on London’s residential market and negative sentiment about what would happen to the UK economy if Britain left the eurozone.

"It was a mixed bag of results for Capco. On the bear side, the slowing London residential market was evident, as sales at Lillie Square came to a standstill in the last quarter.

"The negative sentiment and share price weakness has primarily been on concerns around the London residential market and Brexit, which appears to be more than priced in, and the share now offers attractive value for investors," Mr Clark said.

Long-term prospects were positive. "The Earls Court valuation continued to tick up, albeit at a slower pace to reflect progress with planning permission. The long-term story remains intact, and will get a boost from an increase in density on the site, as well as the recognition of the land parcel, where Capco have exercised an option to acquire.

"On the bullish side, Covent Garden continues to perform well, setting record rents and record leasing levels, which delivered market rental growth of 12% for the estate, and are comfortably on track to deliver rental targets in 2017," Mr Clark said.

Maurice Shapiro, fund manager at Ma’alot Investments, said Capco’s active management of Covent Garden had boosted the group and its overall net asset value.

"Management continue to actively property manage Covent Garden, with impressive leasing ... with top brands such as Chanel. Similarly, management have continued with good development progress in Earls Court. Net asset value growth was strong, with a 16% uplift a share to a net asset value of £3.61. The share is currently trading well below net asset value, both on the JSE and London Stock Exchange."

It has been our most active year of leasing … a milestone that reflects Covent Garden’s importance in global ‘street’ retail

Change: 0.40%

Change: 0.47%

Change: -0.49%

Change: 0.53%

Change: 1.03%

Data supplied by Profile Data

Change: 1.71%

Change: 1.28%

Change: 0.40%

Change: 0.00%

Change: 1.64%

Data supplied by Profile Data

Change: -1.27%

Change: 0.00%

Change: 0.05%

Change: -0.08%

Change: 0.35%

Data supplied by Profile Data

Change: -0.02%

Change: 0.21%

Change: -0.06%

Change: 0.53%

Change: 0.70%

Data supplied by Profile Data