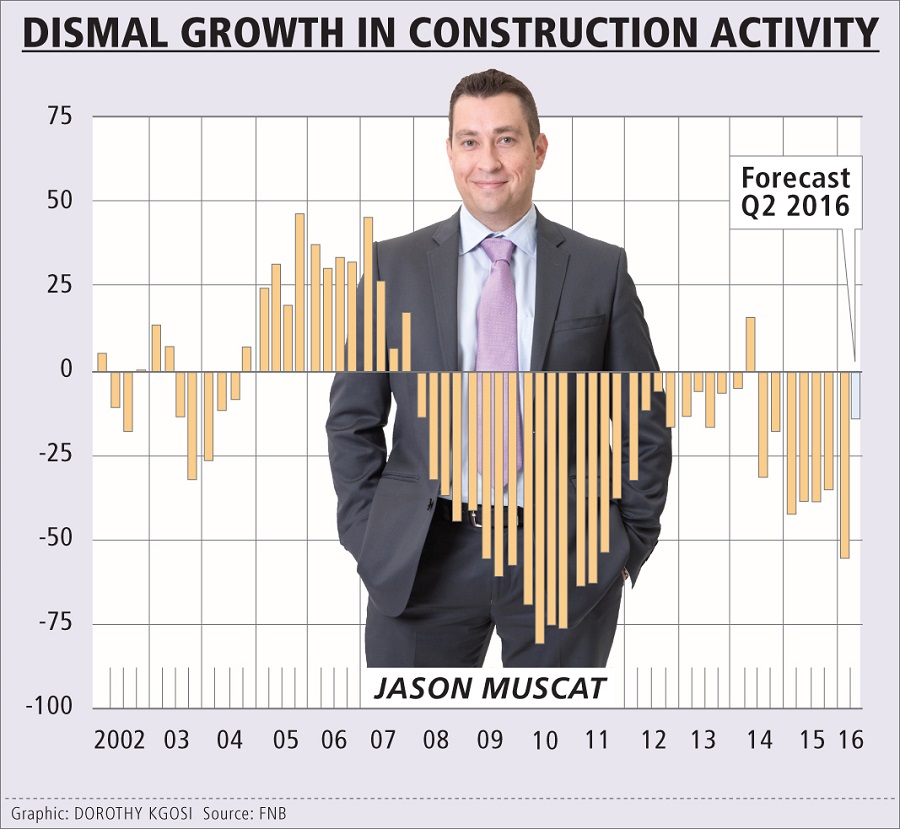

WEAKER construction activity in the first quarter of the year pushed the FNB/BER civil confidence index down 14 points from 42 points in the fourth quarter last year to 28 points, the lowest level of confidence in the industry since the end of 2011.

The fall in confidence out of a total 100 points reflected a "marked deterioration" in activity and a more competitive tender environment, the survey said. It also indicated that more than 70% of respondents were not satisfied with prevailing business conditions.

"The lower confidence is explained by a noticeable weakening in construction activity," Jason Muscat, senior industry analyst at FNB, said on Wednesday.

"The current survey results suggest that, following the mild uptick in the fourth quarter of 2015, growth in construction works likely eased in the first quarter (of this year). As a consequence … tendering competition intensified for those projects that are available," he said.

According to the Reserve Bank, growth in the real value of construction works accelerated to 4% year-on-year in the fourth quarter of last year, from 3.7% in the third quarter of last year.

Activity was mainly supported by provinces and municipalities, while private sector capital expenditure (capex) — particularly in the mining sector — was weak. But despite lower industry activity and higher competition levels overall, profitability was relatively stable, the survey said.

It said respondents expected activity to improve next quarter. However, other data "suggested" the remainder of the year might see construction work slow further, given soft demand.

The latest index data come as three construction companies — Esor, Franki, and Geomech — appeared on Wednesday before the Competition Tribunal, facing allegations of price fixing in the build-up to the 2010 Soccer World Cup. The three were excluded from initial findings by competition authorities as their parent firms were implicated.

Until Franki’s unbundling from Esor, they were both part of JSE-listed Esorfranki (since renamed Esor), while Geomech is a subsidiary of drilling and energy group Geomechanics. Investigations into collusive tendering in the construction sector go back to 2009.

A case against Wilson Bayly Holmes-Ovcon (WBHO) and Group Five of collusion by fixing contractual conditions relating to the N17 link road near Soweto is continuing. Both companies have denied involvement.

Meanwhile, the FNB/BER survey said 85% of respondents rated insufficient demand for new construction work as a business constraint — a four-year high. This could reflect the "downbeat near-term outlook for public-sector capex", Mr Muscat said. "This is especially relevant given that the public sector remains the construction industry’s single biggest client."

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.34%

Change: 0.03%

Change: -0.10%

Change: -0.22%

Change: -0.69%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data