SHORT-term insurer Santam said its medium-term strategy was to expand into Asia and the rest of Africa through its partnership with Sanlam Emerging Markets.

The group will also expand using its reinsurance unit Santam Re and Santam Specialist, which offers among other things, aviation, marine, and transport insurance.

This comes as it finds limited acquisitive growth opportunities in SA due to its dominant position.

Santam, which was started in 1918 and is part of the Sanlam group, has a 22% market share in SA, making it the largest general insurer in the domestic market.

"Acquisitive growth opportunities in the local market are limited, due to Santam’s dominant position, but organic growth remains a focus area, driven by Santam’s well-established intermediary network, integration opportunities with Sanlam’s distribution network and development of the Santam direct distribution channel," the company said in its 2015 annual report.

In the year ended December, about 90% of Santam’s gross written premiums came from SA, 4% from Namibia, 4% from the rest of Africa and 2% Southeast Asia, India, the Middle East and China.

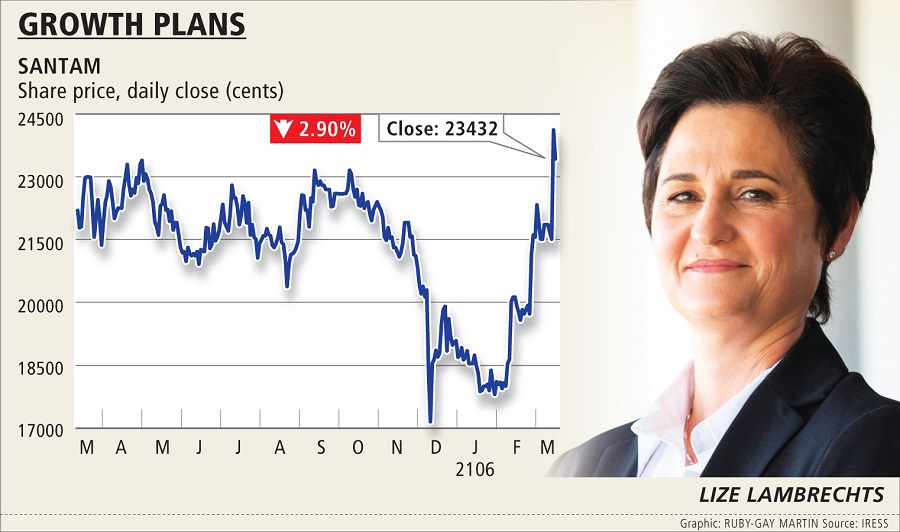

In the period under review, Santam, now headed by Lizé Lambrechts, posted gross written premiums of R24.3bn, a 7% rise compared to the previous year. In the 2015 financial year, Santam posted a net underwriting margin of 9.6%, versus 8.7% in the 2014 financial year. This exceeded a seven-year average of 6.4%.

Ms Lambrechts earned a total remuneration of just less than R26m compared to R10.9m in the year ended 2014. The 2015 remuneration was boosted by a R9.3m she received as part of her out-performance plan, which was in addition to her annual bonus of R6m.

Picture: THINKSTOCK

SHORT-term insurer Santam said its medium-term strategy was to expand into Asia and the rest of Africa through its partnership with Sanlam Emerging Markets.

The group will also expand using its reinsurance unit Santam Re and Santam Specialist, which offers among other things, aviation, marine, and transport insurance.

This comes as it finds limited acquisitive growth opportunities in SA due to its dominant position.

Santam, which was started in 1918 and is part of the Sanlam group, has a 22% market share in SA, making it the largest general insurer in the domestic market.

"Acquisitive growth opportunities in the local market are limited, due to Santam’s dominant position, but organic growth remains a focus area, driven by Santam’s well-established intermediary network, integration opportunities with Sanlam’s distribution network and development of the Santam direct distribution channel," the company said in its 2015 annual report.

In the year ended December, about 90% of Santam’s gross written premiums came from SA, 4% from Namibia, 4% from the rest of Africa and 2% Southeast Asia, India, the Middle East and China.

In the period under review, Santam, now headed by Lizé Lambrechts, posted gross written premiums of R24.3bn, a 7% rise compared to the previous year. In the 2015 financial year, Santam posted a net underwriting margin of 9.6%, versus 8.7% in the 2014 financial year. This exceeded a seven-year average of 6.4%.

Ms Lambrechts earned a total remuneration of just less than R26m compared to R10.9m in the year ended 2014. The 2015 remuneration was boosted by a R9.3m she received as part of her out-performance plan, which was in addition to her annual bonus of R6m.

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.27%

Change: -0.22%

Change: -0.23%

Change: -0.22%

Change: -0.23%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data