SHARES in Santam jumped nearly 11% to an intraday high of R217.97 after SA’s largest short-term insurer posted solid results on Wednesday.

Santam said that to grow the business, it would diversify its specialist business, which offers engineering, property and mining insurance, and its reinsurance business, Santam Re.

"We are targeting more regions. We are targeting Africa and Southeast Asia. If there are opportunities in the Middle East, we will look at it," Santam CEO Lize Lambrechts said.

To diversify these businesses internationally, Ms Lambrechts said, the plan was to follow South African companies in the rest of Africa, and also to source business from companies operating outside the country.

Santam was well-placed to capture some business, with an international broker network.

Ms Lambrechts did not expect a big acquisition, as the company was bedding down a $400m deal it made with Sanlam Emerging Markets.

In November last year, Santam and Sanlam Emerging Markets bought a 30% stake in Saham Finances, the largest insurer in Africa outside SA.

As part of its growth plans, Santam has established a new R4bn note programme and intends to issue up to R1bn of it next month.

"It will enable us to write more business. It’s for operational capital," Ms Lambrechts explained.

Santam chief financial officer Hennie Nel said the company had not issued debt recently and now was probably the right time to do it.

He said the capital would be used to strengthen Santam’s regulatory requirement.

The more business insurers write, the more capital is required to ensure that they can meet claims.

One of Santam’s plans this year is to maintain profitable growth momentum in SA.

Santam posted an underwriting margin of 9.6% in the full-year ended-December last year, compared with 8.7% in the year ended-December 2014. Its underwriting margin is more than the target band of 4%-8%.

Ms Lambrechts said the performance was a combination of underwriting good business and doing well with costs and claims management.

Gross written premiums rose 7% to R24.3bn.

This was lower than the 12% growth in the 2014 financial year. Santam said this was a reflection of competitive market conditions and the downturn in the economic environment.

Gross written premium from the rest of the African continent (excluding Namibia), India, Southeast Asia and China rose by 27.3% to R1.4bn.

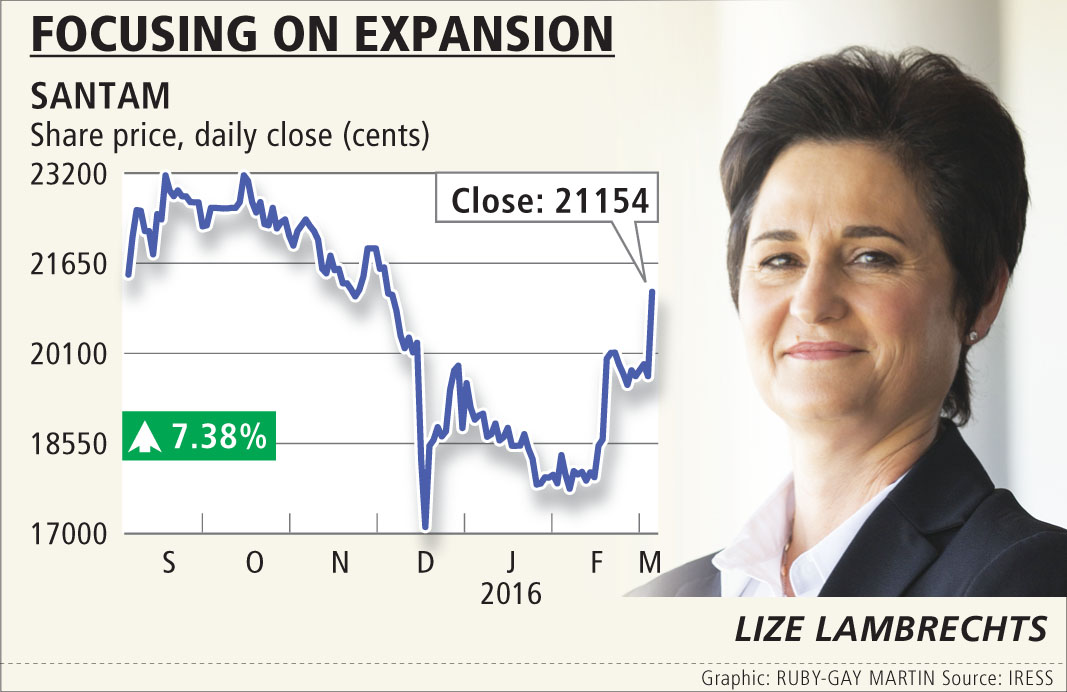

Santam reported a 10% rise in its final dividend to 528c per share. Santam shares ended the day up 7.38% to R211.54.

Santam CEO Lize Lambrechts. Picture: SUPPLIED

SHARES in Santam jumped nearly 11% to an intraday high of R217.97 after SA’s largest short-term insurer posted solid results on Wednesday.

Santam said that to grow the business, it would diversify its specialist business, which offers engineering, property and mining insurance, and its reinsurance business, Santam Re.

"We are targeting more regions. We are targeting Africa and Southeast Asia. If there are opportunities in the Middle East, we will look at it," Santam CEO Lize Lambrechts said.

To diversify these businesses internationally, Ms Lambrechts said, the plan was to follow South African companies in the rest of Africa, and also to source business from companies operating outside the country.

Santam was well-placed to capture some business, with an international broker network.

Ms Lambrechts did not expect a big acquisition, as the company was bedding down a $400m deal it made with Sanlam Emerging Markets.

In November last year, Santam and Sanlam Emerging Markets bought a 30% stake in Saham Finances, the largest insurer in Africa outside SA.

As part of its growth plans, Santam has established a new R4bn note programme and intends to issue up to R1bn of it next month.

"It will enable us to write more business. It’s for operational capital," Ms Lambrechts explained.

Santam chief financial officer Hennie Nel said the company had not issued debt recently and now was probably the right time to do it.

He said the capital would be used to strengthen Santam’s regulatory requirement.

The more business insurers write, the more capital is required to ensure that they can meet claims.

One of Santam’s plans this year is to maintain profitable growth momentum in SA.

Santam posted an underwriting margin of 9.6% in the full-year ended-December last year, compared with 8.7% in the year ended-December 2014. Its underwriting margin is more than the target band of 4%-8%.

Ms Lambrechts said the performance was a combination of underwriting good business and doing well with costs and claims management.

Gross written premiums rose 7% to R24.3bn.

This was lower than the 12% growth in the 2014 financial year. Santam said this was a reflection of competitive market conditions and the downturn in the economic environment.

Gross written premium from the rest of the African continent (excluding Namibia), India, Southeast Asia and China rose by 27.3% to R1.4bn.

Santam reported a 10% rise in its final dividend to 528c per share. Santam shares ended the day up 7.38% to R211.54.

Change: 0.83%

Change: 0.93%

Change: 0.95%

Change: 0.73%

Change: 1.91%

Data supplied by Profile Data

Change: 0.58%

Change: 0.43%

Change: 0.83%

Change: 0.00%

Change: 0.56%

Data supplied by Profile Data

Change: 0.15%

Change: 0.11%

Change: 0.21%

Change: 0.51%

Change: 0.71%

Data supplied by Profile Data

Change: -0.45%

Change: -0.10%

Change: -0.38%

Change: -0.34%

Change: 0.97%

Data supplied by Profile Data