THIS is a critical period for the South African dairy industry, as the sector’s two biggest players and former partners go head-to-head in a battle for market share.

Clover was undoubtedly the happier partner when it stepped away from a 15-year supply agreement with global dairy market giant Danone in 2013, able to finally complete its own line-up of brands, but Danone is looking at the African continent with renewed purpose that will bring the two companies into direct competition.

Danone’s focus on the four major geographical regions in Africa may come with deep pockets Clover can only dream about, but on its home turf, Clover’s well-established brands should allow it to keep increasing its market share, even as Danone — which boasts just more than a quarter of the world’s fresh dairy market by sales volumes in more than 130 territories — ramps up the products it offers in Southern Africa.

Clover CEO Johann Vorster has had to retreat from attempts to break into African markets such as Nigeria and Angola, where logistical and supply-chain challenges thwarted attempts to build its brands, but has now set his sights on beneficiating raw milk by-products from a facility in Estcourt in KwaZulu-Natal for export.

By contrast, Danone has bought controlling stakes in Brookside in Kenya and Fan Milk in Nigeria, where the company employs about 25,000 pushcart bicycle sellers on the streets by way of distribution.

This kind of financial heft has also seen Danone set down farms, such as in Egypt, to ensure a steady supply of milk of the right quality.

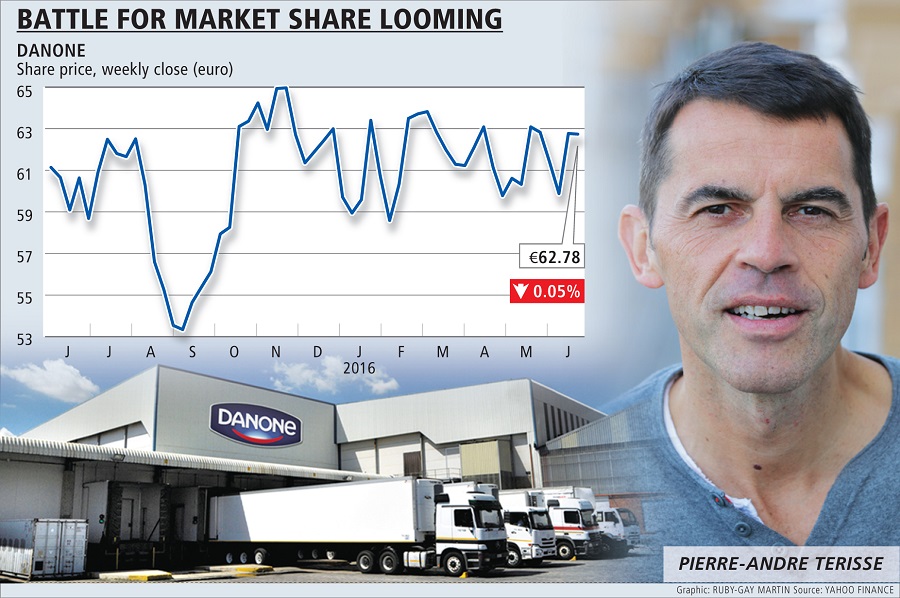

According to Danone’s executive vice-president for Africa, Pierre-André Térisse, 10,000 of Danone’s global workforce of 100,000 are located on the continent, and Africa’s demographic make-up suits the company’s ambition to provide healthy food and infant nutrition products to boost its €1.5bn in annual African sales.

Danone has 19 factories in Africa and is looking to upscale its throughput and the categories in which Danone is represented.

Térisse said the company was innovating at product level to provide what domestic populations eat, rather than shoehorning in successful products from abroad.

After the unbundling of the joint venture, Danone now controls well-known South African brands such as Ultra-Mel, Inkomazi, Yogi-Sip, and Nutriday. Térisse said the company had "only scratched the surface" in terms of categories in which it played in SA.

Globally, the company controls brands such as Evian water, and early-life nutrition brands such as SGM and Nutrilon.

Vunani Securities analyst Anthony Clark believes as South Africans continue to move up the living standards measure ranks and gain access to refrigeration — and their grocery baskets continue to evolve — both Danone and Clover will continue to grow the yoghurt and cheese markets, as well as other convenience food categories. It also illustrates why the powdered and long-life milk categories in SA remain so lucrative.

Exiting the joint venture meant Clover was able to buy the Dairybelle brand to round out its portfolio with yoghurt, Clark said. It also bought out minorities in its beverages division, the fastest-growing and most profitable part of the group.

"It was a very elegant solution for Clover, which now has the manufacturing plant, the brand, and national representation. Clover delivers everywhere, and now has the means to relaunch yoghurt and custard brands. The Clover brand is quite powerful. Danone is a dairy market leader globally, but is quite a recent entrant here."

What Clark sees happening on supermarket shelves is Clover and Danone beginning to squeeze out smaller players such as Parmalat, and ensuring that regional challenger brands remain regional or niche product players. A price war between Clover and Danone, he said, would suit neither party.

Clark said raw milk supply should not be an issue for either of the companies, which would appear to set the stage for both companies being likely to dominate the variety of categories in which they competed in an "equitable price understanding".

As for Clover’s ambitions to export value-added dried products, Clark believes it is not an impossibility that the company may team up with Danone — among other players — again, but he thinks it unlikely, given recent history.

A complication would be introduced in funding arrangements — he said Clover had approached the Industrial Development Corporation, whose empowerment requirements might preclude a hefty stake held by Danone. Either way, Clover will need to rustle up some significant new capital off its balance sheet to get the project under way.

As for Danone, Térisse said the company was prioritising — given the expanse of the continent it is targeting — and was not keen to overcapitalise, while increasing volumes and opening up new category lines. Execution in countries with logistical challenges, he said, would be key.

"This is a very exciting adventure. There is lots of white space, an opportunity to create something for the rest of the group — reinventing models we could use in India, China; even the US and Europe."

Danone executive vice-president for Africa Pierre-André Térisse says Africa's demographic make-up suits the company’s ambition to provide healthy food and infant nutrition products to boost its €1.5bn in annual African sales. Picture: REUTERS/THOMAS MUKOYA

THIS is a critical period for the South African dairy industry, as the sector’s two biggest players and former partners go head-to-head in a battle for market share.

Clover was undoubtedly the happier partner when it stepped away from a 15-year supply agreement with global dairy market giant Danone in 2013, able to finally complete its own line-up of brands, but Danone is looking at the African continent with renewed purpose that will bring the two companies into direct competition.

Danone’s focus on the four major geographical regions in Africa may come with deep pockets Clover can only dream about, but on its home turf, Clover’s well-established brands should allow it to keep increasing its market share, even as Danone — which boasts just more than a quarter of the world’s fresh dairy market by sales volumes in more than 130 territories — ramps up the products it offers in Southern Africa.

Clover CEO Johann Vorster has had to retreat from attempts to break into African markets such as Nigeria and Angola, where logistical and supply-chain challenges thwarted attempts to build its brands, but has now set his sights on beneficiating raw milk by-products from a facility in Estcourt in KwaZulu-Natal for export.

By contrast, Danone has bought controlling stakes in Brookside in Kenya and Fan Milk in Nigeria, where the company employs about 25,000 pushcart bicycle sellers on the streets by way of distribution.

This kind of financial heft has also seen Danone set down farms, such as in Egypt, to ensure a steady supply of milk of the right quality.

According to Danone’s executive vice-president for Africa, Pierre-André Térisse, 10,000 of Danone’s global workforce of 100,000 are located on the continent, and Africa’s demographic make-up suits the company’s ambition to provide healthy food and infant nutrition products to boost its €1.5bn in annual African sales.

Danone has 19 factories in Africa and is looking to upscale its throughput and the categories in which Danone is represented.

Térisse said the company was innovating at product level to provide what domestic populations eat, rather than shoehorning in successful products from abroad.

After the unbundling of the joint venture, Danone now controls well-known South African brands such as Ultra-Mel, Inkomazi, Yogi-Sip, and Nutriday. Térisse said the company had "only scratched the surface" in terms of categories in which it played in SA.

Globally, the company controls brands such as Evian water, and early-life nutrition brands such as SGM and Nutrilon.

Vunani Securities analyst Anthony Clark believes as South Africans continue to move up the living standards measure ranks and gain access to refrigeration — and their grocery baskets continue to evolve — both Danone and Clover will continue to grow the yoghurt and cheese markets, as well as other convenience food categories. It also illustrates why the powdered and long-life milk categories in SA remain so lucrative.

Exiting the joint venture meant Clover was able to buy the Dairybelle brand to round out its portfolio with yoghurt, Clark said. It also bought out minorities in its beverages division, the fastest-growing and most profitable part of the group.

"It was a very elegant solution for Clover, which now has the manufacturing plant, the brand, and national representation. Clover delivers everywhere, and now has the means to relaunch yoghurt and custard brands. The Clover brand is quite powerful. Danone is a dairy market leader globally, but is quite a recent entrant here."

What Clark sees happening on supermarket shelves is Clover and Danone beginning to squeeze out smaller players such as Parmalat, and ensuring that regional challenger brands remain regional or niche product players. A price war between Clover and Danone, he said, would suit neither party.

Clark said raw milk supply should not be an issue for either of the companies, which would appear to set the stage for both companies being likely to dominate the variety of categories in which they competed in an "equitable price understanding".

As for Clover’s ambitions to export value-added dried products, Clark believes it is not an impossibility that the company may team up with Danone — among other players — again, but he thinks it unlikely, given recent history.

A complication would be introduced in funding arrangements — he said Clover had approached the Industrial Development Corporation, whose empowerment requirements might preclude a hefty stake held by Danone. Either way, Clover will need to rustle up some significant new capital off its balance sheet to get the project under way.

As for Danone, Térisse said the company was prioritising — given the expanse of the continent it is targeting — and was not keen to overcapitalise, while increasing volumes and opening up new category lines. Execution in countries with logistical challenges, he said, would be key.

"This is a very exciting adventure. There is lots of white space, an opportunity to create something for the rest of the group — reinventing models we could use in India, China; even the US and Europe."