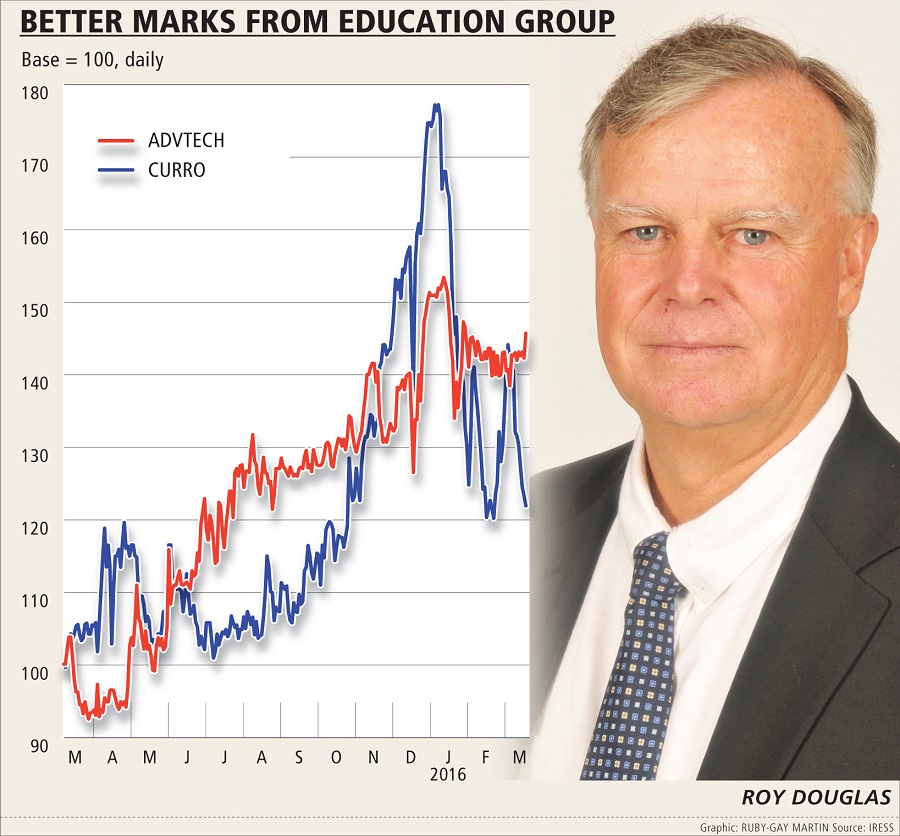

PRIVATE education conglomerate Advtech, owner of the Trinity House, Crawford College and Varsity College brands, has speeded up its earnings growth, thanks to a slew of acquisitions and improvements to its schools portfolio.

CEO Roy Douglas said that Advtech, which released financial results for the year to December on Monday, was on a growth trajectory.

The group grew its headline earnings per share 27% during the year to December, far stronger than the previous year’s 7% growth and 2013’s 12%.

For the year to December, it achieved revenue growth of 40% and a growth in operating profit of 75%.

Advtech has mustered a strong performance after many lacklustre periods, according to Vunani Securities analyst Anthony Clark.

"These are strong results and they needed to be. Advtech’s performance had been drifting, but they bedded down some strong acquisitions that have driven earnings growth.

After nearly six years of staid and static earnings growth, management changes and a better strategy have led to better results," he said.

"Also, their tertiary education division performed very well, taking the pressure off their secondary schools, which only really managed a fair performance and didn’t impress," Mr Clark said.

The tertiary division recorded a 19% rise in revenue to R981.5m, and a 60% rise in profit to R134m.

Mr Douglas, who joined Advtech in 2012 and was charged with fixing its tertiary division, became CEO in November last year, replacing the long-serving Frank Thompson. He said the company was pleased that its capital expenditure of R1.7bn had improved Advtech’s fortunes so quickly.

"The R1.7bn invested during the year in growth projects dramatically increased capacity and enrolments, which resulted in both an increase in assets employed and a harder working and more demanding capital structure," he said.

"We spent about R1.3bn on acquisitions and R400m on extensions. We are planning to spend about R500m in our 2016 financial year.

"We are on a firm growth trajectory now. We intend to make acquisitions this year, details of which we will release gradually," he said.

Mr Clark said Advtech’s acquisitions of Centurus and Maravest had paid off, but that it would find it more difficult to grow earnings through acquisitions this year.

"They have acquired two of the main five private education groups. That reduced their competition to Reddam and Curro. They now need to maximise the revenue they get from their schools division.

"They are also looking at the lower end-priced private-school offering," Mr Clark said.

Curro, the other listed private education group, has tried to take over Advtech in the past.

Curro has established a niche in the lower-fee private-school market.

Mr Douglas said Advtech had noticed the number of new living estates being planned in the country, including Waterfall Estate in Midrand in Gauteng and Steyn City, also in Gauteng, and appreciated that it needed to consider opportunities at these developments.

"We have to look at these and other developments. They often want schools to be included, and we evaluate each and every opportunity," he said.

Mr Clark said with only a few large players in the private education market, companies such as Advtech and Curro had to act quickly, or risk losing out.

Change: 0.83%

Change: 0.93%

Change: 0.95%

Change: 0.73%

Change: 1.91%

Data supplied by Profile Data

Change: 0.53%

Change: 0.01%

Change: 0.83%

Change: 0.00%

Change: 0.05%

Data supplied by Profile Data

Change: 0.36%

Change: 0.04%

Change: 0.14%

Change: -0.07%

Change: 0.24%

Data supplied by Profile Data

Change: -0.27%

Change: -0.10%

Change: -0.20%

Change: 1.06%

Change: 2.98%

Data supplied by Profile Data