FINANCIAL services group Sasfin wants to buy financial technology companies as part of its plan to enhance its banking offering.

The acquisitions will be made through Sasfin’s Private Equity business.

"Around the world there is quite a big move around fintech (financial technology). But we are very cautious about it," said Michael Sassoon, Sasfin’s executive director and head of wealth and capital.

Sasfin CEO Roland Sassoon said the initial investments would not exceed R50m.

Sasfin, established in Johannesburg in 1951, said one of its priorities this year was to conclude a black economic empowerment (BEE) deal.

"In the last three months there have been interested parties. There are three that have expressed real interest," Michael Sassoon said.

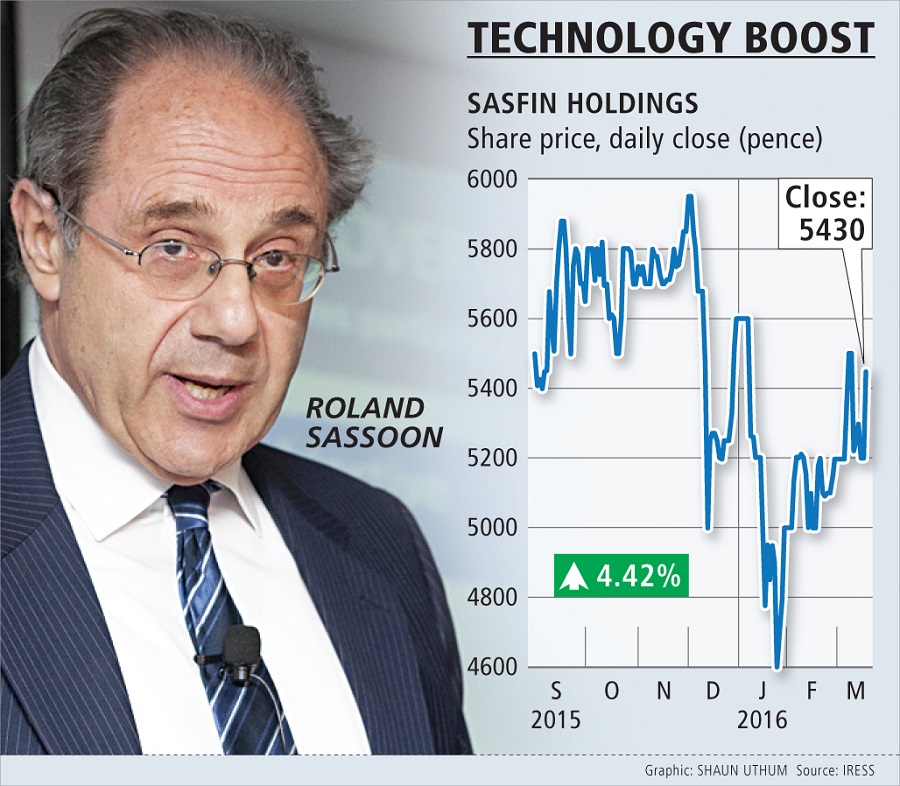

Sasfin was issuing a request for proposals from potential BEE partners. The company’s shares rose more than 5% to R55 in early afternoon trade yesterday.

The group posted a 31% increase in headline earnings to R106.1m in the six months ended December 2015. This is the highest earnings growth so far in SA’s banking sector.

Sasfin finance director Tyrone Soondarjee said the earnings had been boosted by the acquisition of Fintech, a provider of rental finance for equipment such as light office automation, heavy manufacturing and construction plant and machinery.

The Fintech business falls under Sasfin’s business banking division, which posted an 81% rise in profits to R86.2m. Fintech contributed R19.6m to profit after cost of funds.

The wealth business posted a 6% rise in profits to R35m and assets under advisement and management were up 26% to R112bn.

The transactional banking division, which includes treasury, posted a 48% fall in profits to R4m due to what Mr Soondarjee said were startup costs. Sasfin officially launched the transactional banking offering last year.

The capital division reported a loss of R4.8m, hammered by a writedown in a property investment. Roland Sassoon said this related to a residential investment that had been difficult to sell.

In commercial solutions, profits fell 3% to R12.3m, affected by tough trading conditions in freight and global trade.

The group posted a 31% increase in dividends, to 98.57c per share.

Sasfin CEO Roland Sassoon. Picture: FINANCIAL MAIL

FINANCIAL services group Sasfin wants to buy financial technology companies as part of its plan to enhance its banking offering.

The acquisitions will be made through Sasfin’s Private Equity business.

"Around the world there is quite a big move around fintech (financial technology). But we are very cautious about it," said Michael Sassoon, Sasfin’s executive director and head of wealth and capital.

Sasfin CEO Roland Sassoon said the initial investments would not exceed R50m.

Sasfin, established in Johannesburg in 1951, said one of its priorities this year was to conclude a black economic empowerment (BEE) deal.

"In the last three months there have been interested parties. There are three that have expressed real interest," Michael Sassoon said.

Sasfin was issuing a request for proposals from potential BEE partners. The company’s shares rose more than 5% to R55 in early afternoon trade yesterday.

The group posted a 31% increase in headline earnings to R106.1m in the six months ended December 2015. This is the highest earnings growth so far in SA’s banking sector.

Sasfin finance director Tyrone Soondarjee said the earnings had been boosted by the acquisition of Fintech, a provider of rental finance for equipment such as light office automation, heavy manufacturing and construction plant and machinery.

The Fintech business falls under Sasfin’s business banking division, which posted an 81% rise in profits to R86.2m. Fintech contributed R19.6m to profit after cost of funds.

The wealth business posted a 6% rise in profits to R35m and assets under advisement and management were up 26% to R112bn.

The transactional banking division, which includes treasury, posted a 48% fall in profits to R4m due to what Mr Soondarjee said were startup costs. Sasfin officially launched the transactional banking offering last year.

The capital division reported a loss of R4.8m, hammered by a writedown in a property investment. Roland Sassoon said this related to a residential investment that had been difficult to sell.

In commercial solutions, profits fell 3% to R12.3m, affected by tough trading conditions in freight and global trade.

The group posted a 31% increase in dividends, to 98.57c per share.

Change: -0.60%

Change: -0.59%

Change: -1.09%

Change: -0.37%

Change: -0.78%

Data supplied by Profile Data

Change: 0.13%

Change: -0.23%

Change: -0.60%

Change: 0.00%

Change: -0.09%

Data supplied by Profile Data

Change: 0.24%

Change: 0.10%

Change: 0.09%

Change: 0.30%

Change: 0.23%

Data supplied by Profile Data

Change: -1.10%

Change: -1.21%

Change: -0.95%

Change: -1.33%

Change: -0.41%

Data supplied by Profile Data