NASPERS, Africa’s largest company by market value, said fiscal full-year profit growth would be held back by depressed sub-Saharan economies and weaker local currencies.

Best known for its early investment in Chinese e-commerce site Tencent Holdings, Naspers had been absorbing the effect of rising costs so the continent’s struggling consumers would keep paying for Netflix-like service ShowMax and its cable TV offerings, CEO Bob van Dijk said.

Sub-Saharan Africa makes up a fifth of sales at the Cape Town-based company.

"We are trying to help our customers in the region by not raising our prices, even though we buy our content from places like Hollywood and pay for it in dollars," Mr van Dijk said.

Naspers pay-TV business MultiChoice was heavily criticised for increasing monthly tariffs in SA as much as 10%.

The company also launched its digital terrestrial pay-TV platform under GOtv that will, over time, replace the M-Net platform.

Since June 2014, crude oil prices have fallen about 60%.

"This is devastating for economies like Nigeria, a country that also saw its currency weaken significantly," Mr van Dijk said.

Two years into the job, Mr van Dijk is expanding Naspers’s online streaming service across Africa, the least-connected continent with a significant population, to counter Netflix’s domination plans.

But consumers in Africa and Russia, another target market, have lost ground as, commodity prices slumped.

Naspers, which owns Africa’s biggest pay-TV business, spent $1.2bn to gain control of Russian Craigslist copy, Avito, last year.

Valued at $2.4bn in the Naspers deal, Avito would be Russia’s third-largest internet company by capitalisation if it were listed, after social networks operator Mail.ru Group and search engine, Yandex.

Last year, its sales grew the fastest of the three, as Russia’s oil price-induced economic woes offer support for the business model.

Naspers’s hefty bet in an economy mired in recession is paying off, as consumers buy more second-hand clothes, pets, and used cars on Avito.ru, boosting the site’s sales 55% last year.

In the quarter ended-December 2015, Avito’s sales rose 70% to 2.1-billion roubles ($30m). Adjusted earnings before interest, tax, depreciation and amortisation rose 86% to 908-million roubles.

Avito had 30-million unique visitors in January, according to researcher TNS.

To better monetise this audience, the site has gradually started introducing listing fees.

Mr van Dijk plans to expand the online classifieds business in Africa, and was considering Nigeria as the next country to introduce mobile online payments system PayU, he said.

Analysts project Naspers’s revenue will rise 13% to R82.3bn in the year ending March 31, the average of 14 estimates compiled by Bloomberg. Profit, excluding some items, is forecast to more than double to R16.8bn.

The Tencent stake is worth more than $60bn today, more than Naspers’s own market capitalisation, indicating that investors affix no value to Naspers’s other businesses. Tencent is eyeing revenues from the animation industry in China. It has bought the rights to more than 300 Japanese anime franchises, and cultivated others at home with a plan to parlay them into multimedia juggernauts.

The creator of WeChat and QQ intends to generate revenue by putting some comics behind a paywall, and by licensing the characters for movies, games, toys, and clothes. Tencent is chasing a domestic market expected to double in value to $31bn by 2020.

Mr van Dijk is still investing, making bets where he sees opportunities — even if the market disagrees.

"We try not to second guess the market," said Mr van Dijk, a former head of eBay’s German operations.

"In time, the market will start to understand these other businesses and see the value. We want to stay in business in the region and see a lot of potential and opportunities in sub-Saharan Africa still."

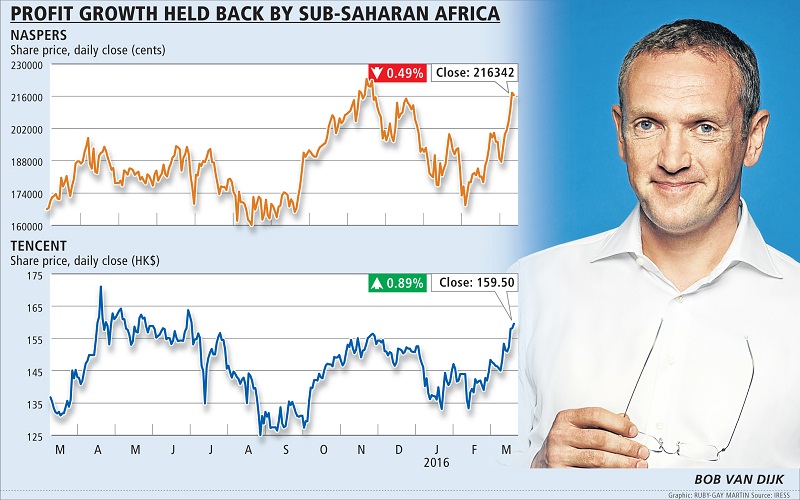

Naspers fell 0.49% to R2,163.42 on Tuesday. Its price has recovered to slightly more than it started the year at, after falling to R1,692 last month. Its shares peaked at R2,233 in November.

Bloomberg, Staff Writer

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.27%

Change: -0.22%

Change: -0.23%

Change: -0.22%

Change: -0.23%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data