Shareholders battle Sovereign pool

by Ann Crotty,

2016-03-18 06:16:59.0

THE increasingly acrimonious battle between Sovereign Foods’ board and a block of its minority shareholders is set to move to the High Court. This follows the launch of an urgent application to set aside the outcome of a controversial shareholders’ meeting held in January.

The litigating shareholders, who are aligned to Country Bird Holdings, also want the court to prevent Sovereign from holding a shareholders’ meeting scheduled for March 29.

The High Court action means the fate of this Uitenhage-based poultry producer is now being fought in two legal forums.

Last week, the Sovereign board applied to the Competition Tribunal in a bid to prevent the same group of shareholders, who have a stake of just more than 7% in Sovereign, from voting at the March 29 meeting.

The board says the tribunal must prevent the Country Bird-aligned shareholders from acquiring any more Sovereign shares ahead of the meeting or voting, because they are acting on behalf of a competitor of Sovereign. If the shareholders are allowed to vote and block the creation of a negative control pool, argues Sovereign, it could result in an effective change of control at Sovereign.

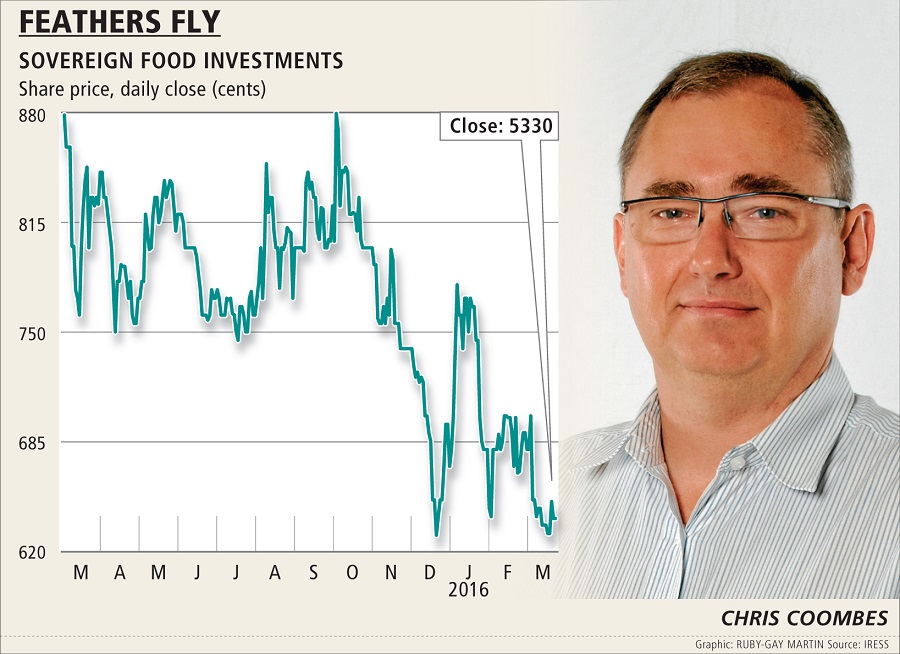

Chris Coombes, Sovereign’s CEO, says the Country Bird-aligned shareholders have been trying to frustrate his company’s broad-based black economic empowerment (BBBEE) deal.

"They are trying to intimidate Sovereign into concluding a transaction with them, on their terms," Mr Coombes says.

The focal point of the battle is a board-backed scheme to introduce a BBBEE party into the company’s shareholding. While the shareholders doing battle with the board welcome the introduction of a BBBEE shareholder, they baulk at the board using the move to create a negative-control pool that would see a group of executives hold 45% of a combined executive/ BBBEE 28% stake.

At the January 14 meeting, just more than 85% of the shareholders voted in support of the scheme, which also involved buying back 10% of the shares at R8.50 a share, for a total cost of about R70m. This was presented as a payback to shareholders for their long-term support.

However, because the buyback was for more than 5% of the shares, the company was obliged in terms of the new Companies Act to offer appraisal rights to dissenting shareholders who were unhappy with the deal and wanted to exit the company.

About 11% of the shareholders applied for dissenting rights, which meant Sovereign was required to buy them out at "fair value", likely to be in line with the R8.50 of the buyback.

The Sovereign board quickly realised the bill for the buyback as well as the buyout of dissenting shareholders, was steeper than the company could afford. It announced it was abandoning the scheme, which it was entitled to do, given that a condition of the scheme was that no more than 5% of shareholders would apply for appraisal rights.

A revised proposal, which is essentially the old one with the buyback cut to 5%, will be put to shareholders at the March 29 meeting. The critical issue now is the rights of the dissenting shareholders at that meeting.

Nonaligned dissenter Albie Cilliers says although the earlier scheme has been scrapped, he has been told he will be unable to vote because he had been granted appraisal rights for that scheme. If he gives up his appraisal rights, he will be able to vote, but Cilliers fears if he, and a sufficient number of other dissenters, give up these rights, the board may then decide to abandon the second scheme and implement the first one.

Picture: THINKSTOCK

THE increasingly acrimonious battle between Sovereign Foods’ board and a block of its minority shareholders is set to move to the High Court. This follows the launch of an urgent application to set aside the outcome of a controversial shareholders’ meeting held in January.

The litigating shareholders, who are aligned to Country Bird Holdings, also want the court to prevent Sovereign from holding a shareholders’ meeting scheduled for March 29.

The High Court action means the fate of this Uitenhage-based poultry producer is now being fought in two legal forums.

Last week, the Sovereign board applied to the Competition Tribunal in a bid to prevent the same group of shareholders, who have a stake of just more than 7% in Sovereign, from voting at the March 29 meeting.

The board says the tribunal must prevent the Country Bird-aligned shareholders from acquiring any more Sovereign shares ahead of the meeting or voting, because they are acting on behalf of a competitor of Sovereign. If the shareholders are allowed to vote and block the creation of a negative control pool, argues Sovereign, it could result in an effective change of control at Sovereign.

Chris Coombes, Sovereign’s CEO, says the Country Bird-aligned shareholders have been trying to frustrate his company’s broad-based black economic empowerment (BBBEE) deal.

"They are trying to intimidate Sovereign into concluding a transaction with them, on their terms," Mr Coombes says.

The focal point of the battle is a board-backed scheme to introduce a BBBEE party into the company’s shareholding. While the shareholders doing battle with the board welcome the introduction of a BBBEE shareholder, they baulk at the board using the move to create a negative-control pool that would see a group of executives hold 45% of a combined executive/ BBBEE 28% stake.

At the January 14 meeting, just more than 85% of the shareholders voted in support of the scheme, which also involved buying back 10% of the shares at R8.50 a share, for a total cost of about R70m. This was presented as a payback to shareholders for their long-term support.

However, because the buyback was for more than 5% of the shares, the company was obliged in terms of the new Companies Act to offer appraisal rights to dissenting shareholders who were unhappy with the deal and wanted to exit the company.

About 11% of the shareholders applied for dissenting rights, which meant Sovereign was required to buy them out at "fair value", likely to be in line with the R8.50 of the buyback.

The Sovereign board quickly realised the bill for the buyback as well as the buyout of dissenting shareholders, was steeper than the company could afford. It announced it was abandoning the scheme, which it was entitled to do, given that a condition of the scheme was that no more than 5% of shareholders would apply for appraisal rights.

A revised proposal, which is essentially the old one with the buyback cut to 5%, will be put to shareholders at the March 29 meeting. The critical issue now is the rights of the dissenting shareholders at that meeting.

Nonaligned dissenter Albie Cilliers says although the earlier scheme has been scrapped, he has been told he will be unable to vote because he had been granted appraisal rights for that scheme. If he gives up his appraisal rights, he will be able to vote, but Cilliers fears if he, and a sufficient number of other dissenters, give up these rights, the board may then decide to abandon the second scheme and implement the first one.

Change: 1.19%

Change: 1.36%

Change: 2.19%

Change: 1.49%

Change: -0.77%

Data supplied by Profile Data

Change: -0.19%

Change: 0.69%

Change: 1.19%

Change: 0.00%

Change: 0.44%

Data supplied by Profile Data

Change: 0.62%

Change: 0.61%

Change: 0.23%

Change: 0.52%

Change: 0.12%

Data supplied by Profile Data

Change: -0.21%

Change: -1.22%

Change: -0.69%

Change: -0.51%

Change: 0.07%

Data supplied by Profile Data