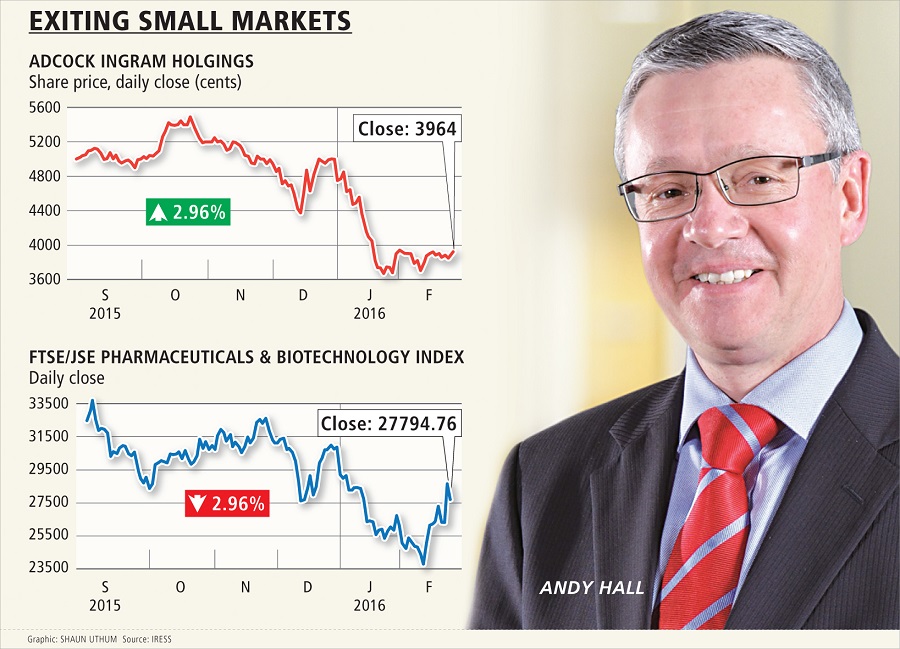

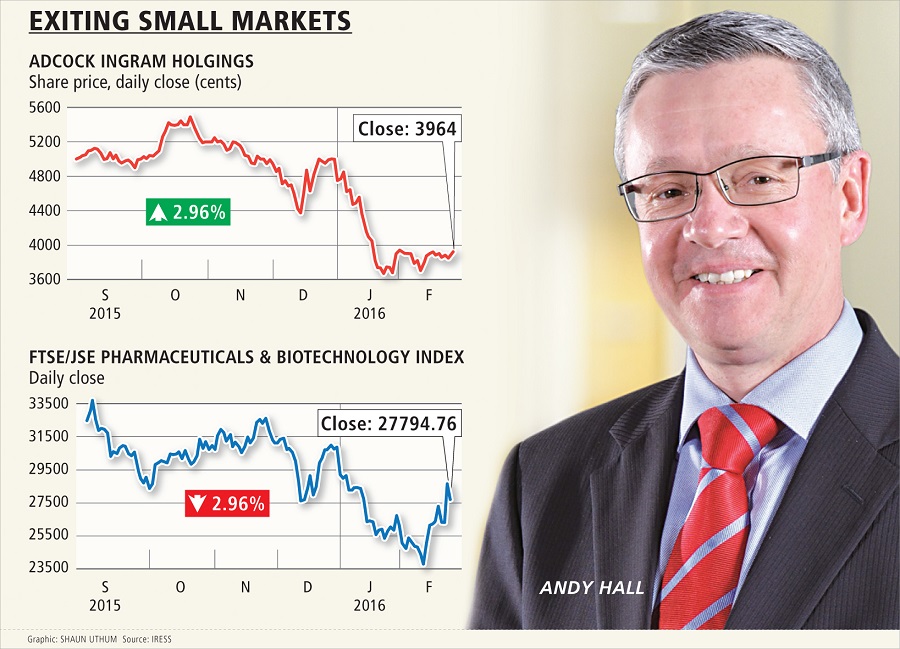

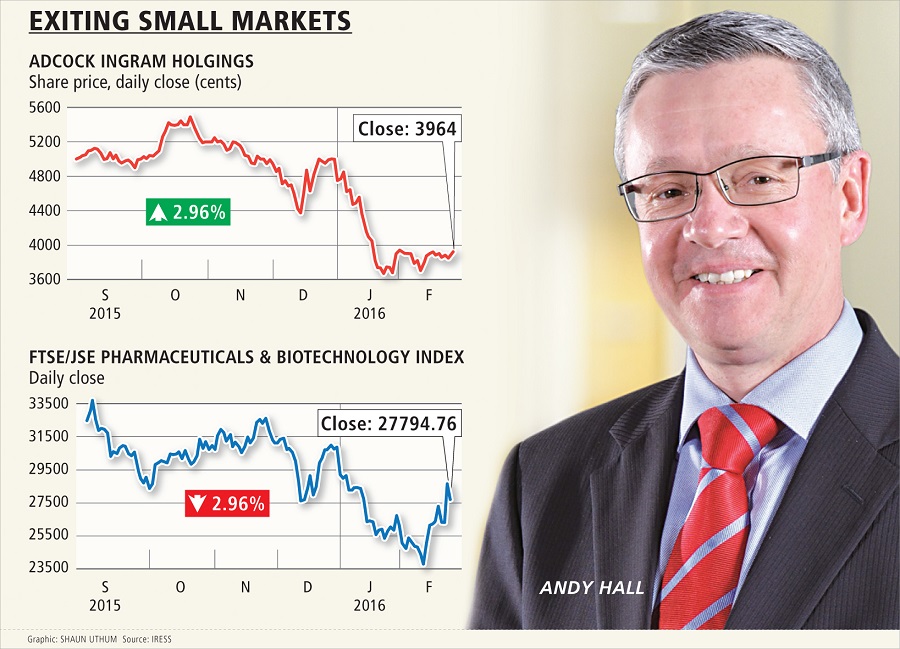

PHARMACEUTICAL manufacturer Adcock Ingram has engaged a broker to help it shed its controlling stake in Ghana-listed Ayrton Drugs, and plans to sell its Indian business Cosme Farma this year.

It forms part of Adcock’s strategy to focus on growing its southern African business.

Adcock is the maker of brands such as Panado, Compral, Corenza C and Allergex.

It says its relatively small international assets extract much management time and focus. "In Ghana, we have made a decision to exit by selling the business," CEO Andy Hall said on Wednesday after the release of the company’s interim results for the six months to December.

Adcock owns just less than 80% of Ghana’s Ayrton Drugs.

"We would hope to conclude the deal, certainly within the calendar year.… It’s not yet as advanced as the Indian process," Mr Hall said.

Its MD in Ghana had "done a great job", under tough economic conditions.

An investment bank in India had been engaged to initiate a sales process in which interested parties would be invited to look at the business. Mr Hall said a number of companies had shown interest in acquiring Cosme. He could not disclose the parties or the deal values.

The plan is to do a deal in India by the end of the year. Adcock will retain its manufacturing capability in India and regulatory teams in Bangalore.

Adcock, whose largest single shareholder is Brian Joffe’s Bidvest, also has businesses in Zimbabwe and Kenya. All three its operations in the rest of Africa were profitable, Mr Hall said. Adcock Ingram was retaining its business in Zimbabwe, as it runs independently under good management. But the Kenyan business was small and under review.

"What we are not keen on doing is investing in fixed infrastructure in the rest of Africa," Mr Hall said.

He added that proceeds from the sale in Ghana and India would probably be invested in Adcock Ingram’s nonregulated products portfolio. These include skin creams, home, and baby care items.

"We are in the process of qualifying categories of investments or companies we might wish to target. Certainly, we are going to look for acquisitions aggressively in the next few months," Mr Hall said. "What it (nonregulated products) allows us to do is to have more flexibility on pricing and thus recovering costs," he added.

In the nonregulated products market, Adcock was looking to acquire owner-managed businesses with good brands.

Adcock grew its interim turnover 7% to R2.75bn, while gross profit rose 11% to just more than R1bn. The group’s trading profit was up 20% to R293m.

Adcock’s over-the-counter division increased turnover 9% to R761.5m, and its prescription business grew turnover by 1.3% to R892.4m. Turnover in the consumer segment was up 8% to R328.1m, and the hospital division grew turnover 12% to R626.2m in the period under review. Turnover in the rest of Africa and India business was up 18% to R159.1m.

A dividend of 50c per share was declared.

Mr Hall said he was reasonably pleased with the turnover, considering the depreciating rand, rising interest rates and increasing inflation. He was happy with the 11% gross profit growth, which was partly due to improved control of inventory and reduced write-offs.

The company said its reorganised divisional management structure had helped to boost trading profit.

A sign outside the Adcock Ingram offices in Johannesburg. Picture: REUTERS

PHARMACEUTICAL manufacturer Adcock Ingram has engaged a broker to help it shed its controlling stake in Ghana-listed Ayrton Drugs, and plans to sell its Indian business Cosme Farma this year.

It forms part of Adcock’s strategy to focus on growing its southern African business.

Adcock is the maker of brands such as Panado, Compral, Corenza C and Allergex.

It says its relatively small international assets extract much management time and focus. "In Ghana, we have made a decision to exit by selling the business," CEO Andy Hall said on Wednesday after the release of the company’s interim results for the six months to December.

Adcock owns just less than 80% of Ghana’s Ayrton Drugs.

"We would hope to conclude the deal, certainly within the calendar year.… It’s not yet as advanced as the Indian process," Mr Hall said.

Its MD in Ghana had "done a great job", under tough economic conditions.

An investment bank in India had been engaged to initiate a sales process in which interested parties would be invited to look at the business. Mr Hall said a number of companies had shown interest in acquiring Cosme. He could not disclose the parties or the deal values.

The plan is to do a deal in India by the end of the year. Adcock will retain its manufacturing capability in India and regulatory teams in Bangalore.

Adcock, whose largest single shareholder is Brian Joffe’s Bidvest, also has businesses in Zimbabwe and Kenya. All three its operations in the rest of Africa were profitable, Mr Hall said. Adcock Ingram was retaining its business in Zimbabwe, as it runs independently under good management. But the Kenyan business was small and under review.

"What we are not keen on doing is investing in fixed infrastructure in the rest of Africa," Mr Hall said.

He added that proceeds from the sale in Ghana and India would probably be invested in Adcock Ingram’s nonregulated products portfolio. These include skin creams, home, and baby care items.

"We are in the process of qualifying categories of investments or companies we might wish to target. Certainly, we are going to look for acquisitions aggressively in the next few months," Mr Hall said. "What it (nonregulated products) allows us to do is to have more flexibility on pricing and thus recovering costs," he added.

In the nonregulated products market, Adcock was looking to acquire owner-managed businesses with good brands.

Adcock grew its interim turnover 7% to R2.75bn, while gross profit rose 11% to just more than R1bn. The group’s trading profit was up 20% to R293m.

Adcock’s over-the-counter division increased turnover 9% to R761.5m, and its prescription business grew turnover by 1.3% to R892.4m. Turnover in the consumer segment was up 8% to R328.1m, and the hospital division grew turnover 12% to R626.2m in the period under review. Turnover in the rest of Africa and India business was up 18% to R159.1m.

A dividend of 50c per share was declared.

Mr Hall said he was reasonably pleased with the turnover, considering the depreciating rand, rising interest rates and increasing inflation. He was happy with the 11% gross profit growth, which was partly due to improved control of inventory and reduced write-offs.

The company said its reorganised divisional management structure had helped to boost trading profit.

Change: -0.42%

Change: -0.35%

Change: -0.17%

Change: 0.14%

Change: -2.58%

Data supplied by Profile Data

Change: -0.56%

Change: 0.13%

Change: -0.42%

Change: 0.00%

Change: -0.18%

Data supplied by Profile Data

Change: 2.51%

Change: 1.47%

Change: 2.57%

Change: 3.09%

Change: 1.90%

Data supplied by Profile Data

Change: -0.26%

Change: -0.10%

Change: -0.52%

Change: 0.00%

Change: -1.94%

Data supplied by Profile Data