ACQUISITIVE healthcare brands conglomerate Ascendis is gearing up for further offshore advances, and has even increased its dividend cover in anticipation of such a move.

On Wednesday, the company, controlled by private equity group Coast 2 Coast, reported that revenue from foreign markets increased more than 200% to R365m in the half-year to end December. Foreign revenues now account for a chunky 20% of total sales.

Ascendis CEO Karsten Wellner said the company was firmly on track to achieve 30% revenue from outside SA by next year through exports, setting up offshore offices and acquiring international businesses.

Last year, the company acquired Spanish pharmaceutical company Farmalider, markedly boosting its offshore revenues. Ascendis also exports to more than 50 countries — mainly through its Swissgarde, Avima, and Nimue brands, as well as medical devices specialist, The Scientific Group.

Plans for the second half of the financial year included focusing on international acquisitive growth to further improve Ascendis’s hard currency revenue base, Dr Wellner said.

"We are currently evaluating opportunities to acquire companies for all three divisions in Australia and Europe."

Ascendis was also looking at South African companies that could enhance the overall export offering, he said, noting that a small phyto-vet business, Ortus, had been acquired earlier this year. "A large part of sales generated by Ortus is in dollars and euros, and the margins are reasonably good."

Dr Wellner said it was likely that the company would look for one or two big opportunities to build new operational platforms in Europe, and a number of smaller acquisitions in Australia.

"We should be able to achieve the target of generating 30% of our revenue offshore in the next six months."

Ascendis could look to a fresh capital raising — either by a rights issue or vendor placement — if a sizeable offshore deal were landed.

"We have the support of our existing shareholders and we think there will be support both locally and internationally if we raise capital by issuing more shares," Dr Wellner said.

A market source, who asked not to be named, said a more conservative dividend policy suggested a sizeable deal might be in the offing for Ascendis.

Ascendis hiked its interim payout 19% to 9.5c per share, which lags the 37% increase in headline earnings to 49c per share, and 31% increase in normalised earnings to 56c per share. The dividend was covered almost six times by normalised earnings compared with four times last year.

Dr Wellner confirmed the company would stick to a six times dividend cover. "After speaking to our shareholders, it was decided that while we are in an acquisitive growth phase, we should not pay such a big dividend from earnings," he said.

Although Ascendis was not widely covered by investment houses, market sources did note that the revenue and profit breakdown at the company had changed markedly in the past 12 months.

There was also some reassurance that Ascendis’s customer spread was diverse and not overly reliant on a specific sector. In the interim period, the biggest sales segments were private hospitals and retailers, each representing 22% of total sales.

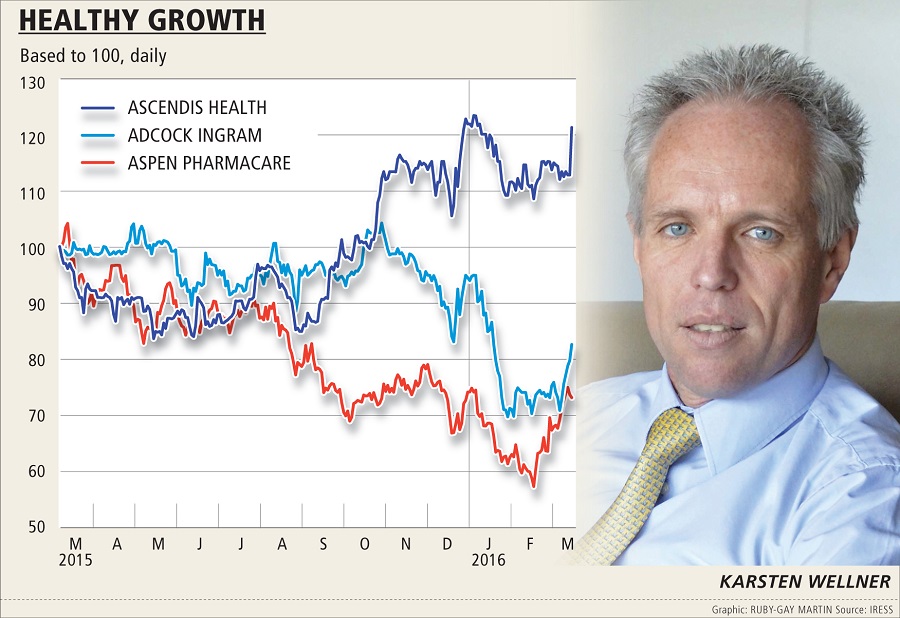

Ascendis CEO Karsten Wellner. Picture: TREVOR SAMSON

ACQUISITIVE healthcare brands conglomerate Ascendis is gearing up for further offshore advances, and has even increased its dividend cover in anticipation of such a move.

On Wednesday, the company, controlled by private equity group Coast 2 Coast, reported that revenue from foreign markets increased more than 200% to R365m in the half-year to end December. Foreign revenues now account for a chunky 20% of total sales.

Ascendis CEO Karsten Wellner said the company was firmly on track to achieve 30% revenue from outside SA by next year through exports, setting up offshore offices and acquiring international businesses.

Last year, the company acquired Spanish pharmaceutical company Farmalider, markedly boosting its offshore revenues. Ascendis also exports to more than 50 countries — mainly through its Swissgarde, Avima, and Nimue brands, as well as medical devices specialist, The Scientific Group.

Plans for the second half of the financial year included focusing on international acquisitive growth to further improve Ascendis’s hard currency revenue base, Dr Wellner said.

"We are currently evaluating opportunities to acquire companies for all three divisions in Australia and Europe."

Ascendis was also looking at South African companies that could enhance the overall export offering, he said, noting that a small phyto-vet business, Ortus, had been acquired earlier this year. "A large part of sales generated by Ortus is in dollars and euros, and the margins are reasonably good."

Dr Wellner said it was likely that the company would look for one or two big opportunities to build new operational platforms in Europe, and a number of smaller acquisitions in Australia.

"We should be able to achieve the target of generating 30% of our revenue offshore in the next six months."

Ascendis could look to a fresh capital raising — either by a rights issue or vendor placement — if a sizeable offshore deal were landed.

"We have the support of our existing shareholders and we think there will be support both locally and internationally if we raise capital by issuing more shares," Dr Wellner said.

A market source, who asked not to be named, said a more conservative dividend policy suggested a sizeable deal might be in the offing for Ascendis.

Ascendis hiked its interim payout 19% to 9.5c per share, which lags the 37% increase in headline earnings to 49c per share, and 31% increase in normalised earnings to 56c per share. The dividend was covered almost six times by normalised earnings compared with four times last year.

Dr Wellner confirmed the company would stick to a six times dividend cover. "After speaking to our shareholders, it was decided that while we are in an acquisitive growth phase, we should not pay such a big dividend from earnings," he said.

Although Ascendis was not widely covered by investment houses, market sources did note that the revenue and profit breakdown at the company had changed markedly in the past 12 months.

There was also some reassurance that Ascendis’s customer spread was diverse and not overly reliant on a specific sector. In the interim period, the biggest sales segments were private hospitals and retailers, each representing 22% of total sales.

Change: 0.40%

Change: 0.47%

Change: -0.49%

Change: 0.53%

Change: 1.03%

Data supplied by Profile Data

Change: 1.71%

Change: 1.28%

Change: 0.40%

Change: 0.00%

Change: 1.64%

Data supplied by Profile Data

Change: -1.27%

Change: 0.00%

Change: 0.05%

Change: -0.08%

Change: 0.35%

Data supplied by Profile Data

Change: -0.02%

Change: 0.21%

Change: -0.06%

Change: 0.53%

Change: 0.70%

Data supplied by Profile Data