PERSONAL TAXES: Lack of relief means bigger tax bill for high earners

by Linda Ensor and Moyagabo Maake,

2016-02-25 06:09:59.0

TREASURY has increased taxes for high income earners by failing to compensate them fully for fiscal drag as it normally does each year.

Personal income tax relief of R5.5bn has been extended, but is R7.6bn less than the R13.1bn needed to account fully for fiscal drag. Fiscal drag is the effect of inflation which pushes taxpayers into higher tax brackets.

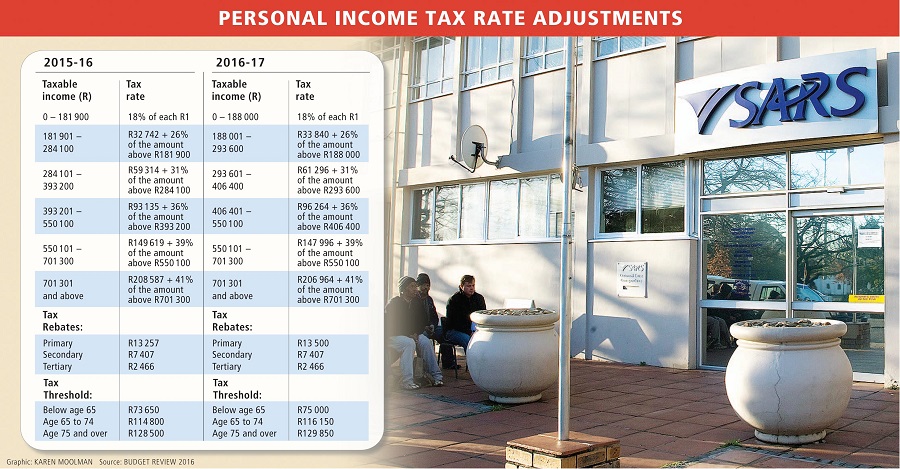

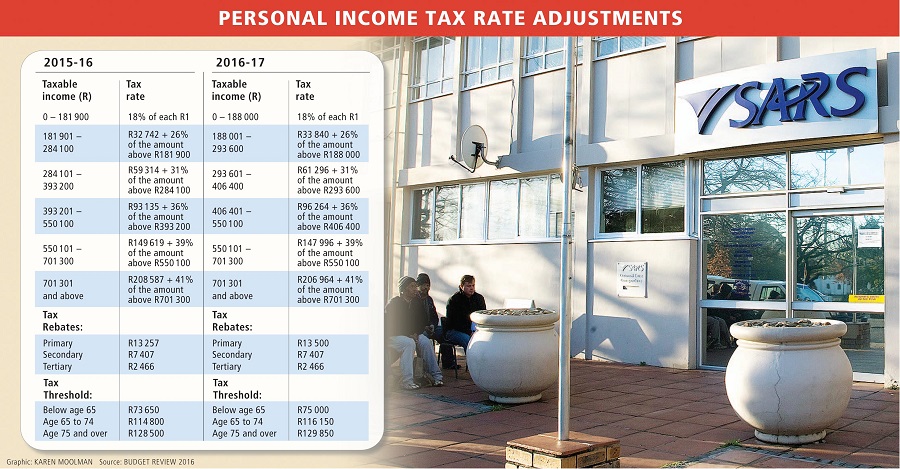

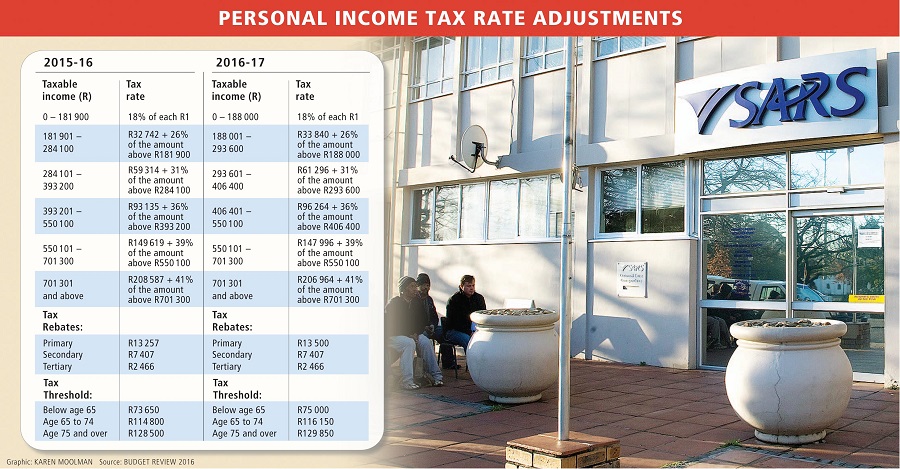

The benefit of the tax relief is mainly focused on lower and middle income earners. There is no change to the tax brackets and rates for those earning R550,101 and more. The first tax bracket kicks off for income of R188,000 instead of the previous R181 ,900. The bottom three income brackets are adjusted by 3.4%.

The primary rebate has been increased by 1.8% to R13,500 per year for all individuals. The secondary rebate, which applies to those 65 and over, remains at R7,407 per year, and the rebate for those 75 years and older at R2,466 per year.

The threshold below which individuals are not subject to personal income tax is increased to R75,000 of taxable income per year for those below 65, to R116,150 per year for those aged 65 to 74, and R129,850 for those aged 75 and over.

Tax credits for medical aid contributions have been raised in line with inflation from R270 to R286 per month from March 1 for the first two beneficiaries, and from R181 to R192 for additional ones.

The cost of this relief for the fiscus is estimated at R1.1bn.

The maximum effective capital gains tax for individuals will increase from 13.7% to 16.4%.

For companies, it will rise from 18.6% to 22.4%.

The annual amount above which capital gains will be taxable for individuals will increase from R30,000 to R40,000.

The effective rate applicable to trusts will increase from 27.3% to 32.8%.

Vedika Andhee, tax director at EY Africa, said income tax savings will be enjoyed by all categories of taxpayers, contrary to expectations.

"To illustrate, a person earning R6,500 taxable remuneration per month will pay R243 less tax from March 2016," she said.

"A person earning R25,000 taxable remuneration per month will pay R1, 206 less tax. Even high income earners, such as those earning R80,000 per month will enjoy a saving of R1,866 per month."

On capital gains tax, Ms Andhee said that the increase in the effective capital gains tax rate, although expected, meant individuals would be giving more thought to where and how to invest their money.

Karen Botha, a senior manager at PwC's tax practice, said despite numerous rumours that the marginal personal income tax rates could be increased, it is proposed that they remain the same for all income tax brackets.

"When comparing an individual's tax liability who earns approximately R100,000 per year, the individual will have an additional R20.25 extra in their pockets every month," she said.

"This barely covers the ever-rising cost of fuel and consumables.

"When comparing an individual's tax liability who earns approximately R1m per year, the individual will have R155.53 more cash to take home every month.

"It comes at a surprise that the higher income earners will have more cash in their pockets this year."

Greg Tarrant, an associate director at PwC, said increases in capital gains taxes to be levied on companies and trusts made them virtually indistinguishable.

"This narrows the arbitrage between capital and revenue gains for companies and trusts almost to the point where one wonders why one should distinguish between them at all," he said.

"Also, South Africa has relatively high inflation (we've just seen a revision to 6.1%) and it has long been pointed out to Treasury that taxing capital gains is akin to taxing inflation.

"The situation now becomes worse where these gains are taxed at higher effective rates."

CAPITAL GAINS: Harder thinking ahead about investments. Picture: DAILY DISPATCH

TREASURY has increased taxes for high income earners by failing to compensate them fully for fiscal drag as it normally does each year.

Personal income tax relief of R5.5bn has been extended, but is R7.6bn less than the R13.1bn needed to account fully for fiscal drag. Fiscal drag is the effect of inflation which pushes taxpayers into higher tax brackets.

The benefit of the tax relief is mainly focused on lower and middle income earners. There is no change to the tax brackets and rates for those earning R550,101 and more. The first tax bracket kicks off for income of R188,000 instead of the previous R181 ,900. The bottom three income brackets are adjusted by 3.4%.

The primary rebate has been increased by 1.8% to R13,500 per year for all individuals. The secondary rebate, which applies to those 65 and over, remains at R7,407 per year, and the rebate for those 75 years and older at R2,466 per year.

The threshold below which individuals are not subject to personal income tax is increased to R75,000 of taxable income per year for those below 65, to R116,150 per year for those aged 65 to 74, and R129,850 for those aged 75 and over.

Tax credits for medical aid contributions have been raised in line with inflation from R270 to R286 per month from March 1 for the first two beneficiaries, and from R181 to R192 for additional ones.

The cost of this relief for the fiscus is estimated at R1.1bn.

The maximum effective capital gains tax for individuals will increase from 13.7% to 16.4%.

For companies, it will rise from 18.6% to 22.4%.

The annual amount above which capital gains will be taxable for individuals will increase from R30,000 to R40,000.

The effective rate applicable to trusts will increase from 27.3% to 32.8%.

Vedika Andhee, tax director at EY Africa, said income tax savings will be enjoyed by all categories of taxpayers, contrary to expectations.

"To illustrate, a person earning R6,500 taxable remuneration per month will pay R243 less tax from March 2016," she said.

"A person earning R25,000 taxable remuneration per month will pay R1, 206 less tax. Even high income earners, such as those earning R80,000 per month will enjoy a saving of R1,866 per month."

On capital gains tax, Ms Andhee said that the increase in the effective capital gains tax rate, although expected, meant individuals would be giving more thought to where and how to invest their money.

Karen Botha, a senior manager at PwC's tax practice, said despite numerous rumours that the marginal personal income tax rates could be increased, it is proposed that they remain the same for all income tax brackets.

"When comparing an individual's tax liability who earns approximately R100,000 per year, the individual will have an additional R20.25 extra in their pockets every month," she said.

"This barely covers the ever-rising cost of fuel and consumables.

"When comparing an individual's tax liability who earns approximately R1m per year, the individual will have R155.53 more cash to take home every month.

"It comes at a surprise that the higher income earners will have more cash in their pockets this year."

Greg Tarrant, an associate director at PwC, said increases in capital gains taxes to be levied on companies and trusts made them virtually indistinguishable.

"This narrows the arbitrage between capital and revenue gains for companies and trusts almost to the point where one wonders why one should distinguish between them at all," he said.

"Also, South Africa has relatively high inflation (we've just seen a revision to 6.1%) and it has long been pointed out to Treasury that taxing capital gains is akin to taxing inflation.

"The situation now becomes worse where these gains are taxed at higher effective rates."

News, views and analysis of Finance Minister Pravin Gordhan's 2016 budget

News, views and analysis of Finance Minister Pravin Gordhan's 2016 budget

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.34%

Change: 0.03%

Change: -0.10%

Change: -0.22%

Change: -0.69%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data