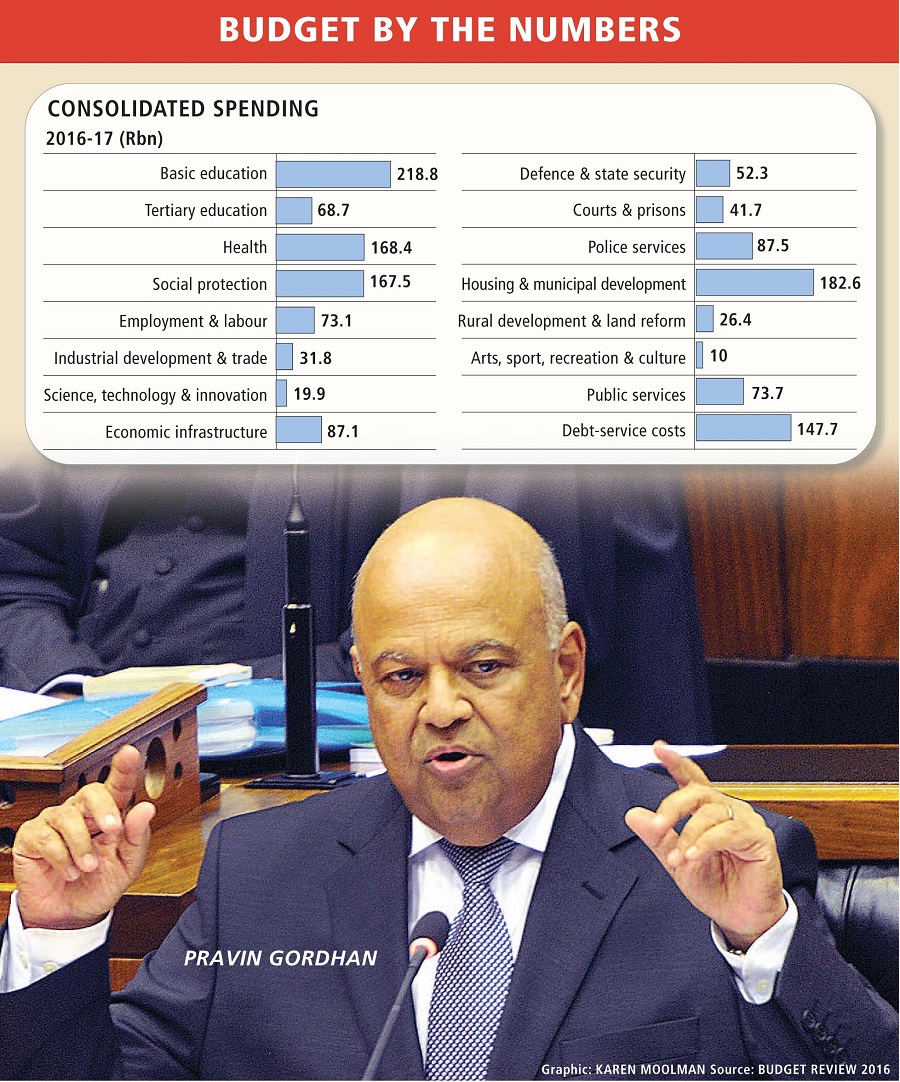

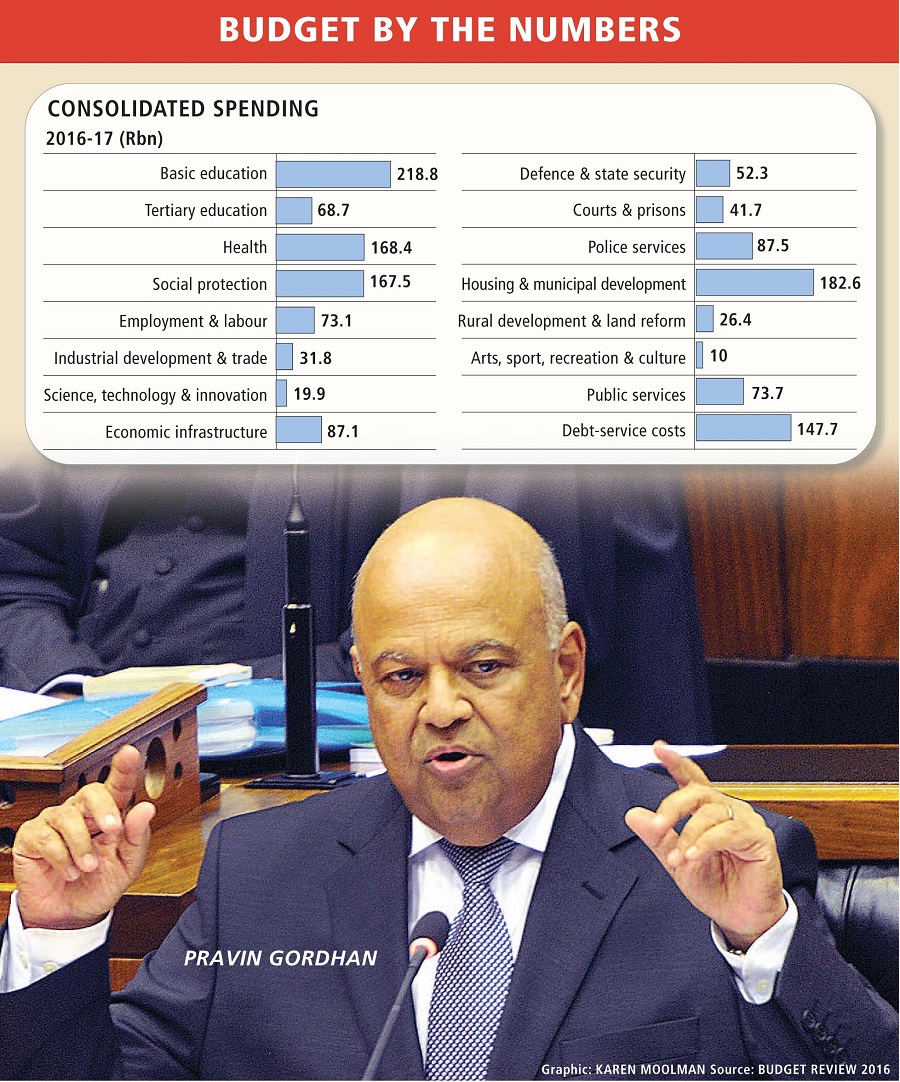

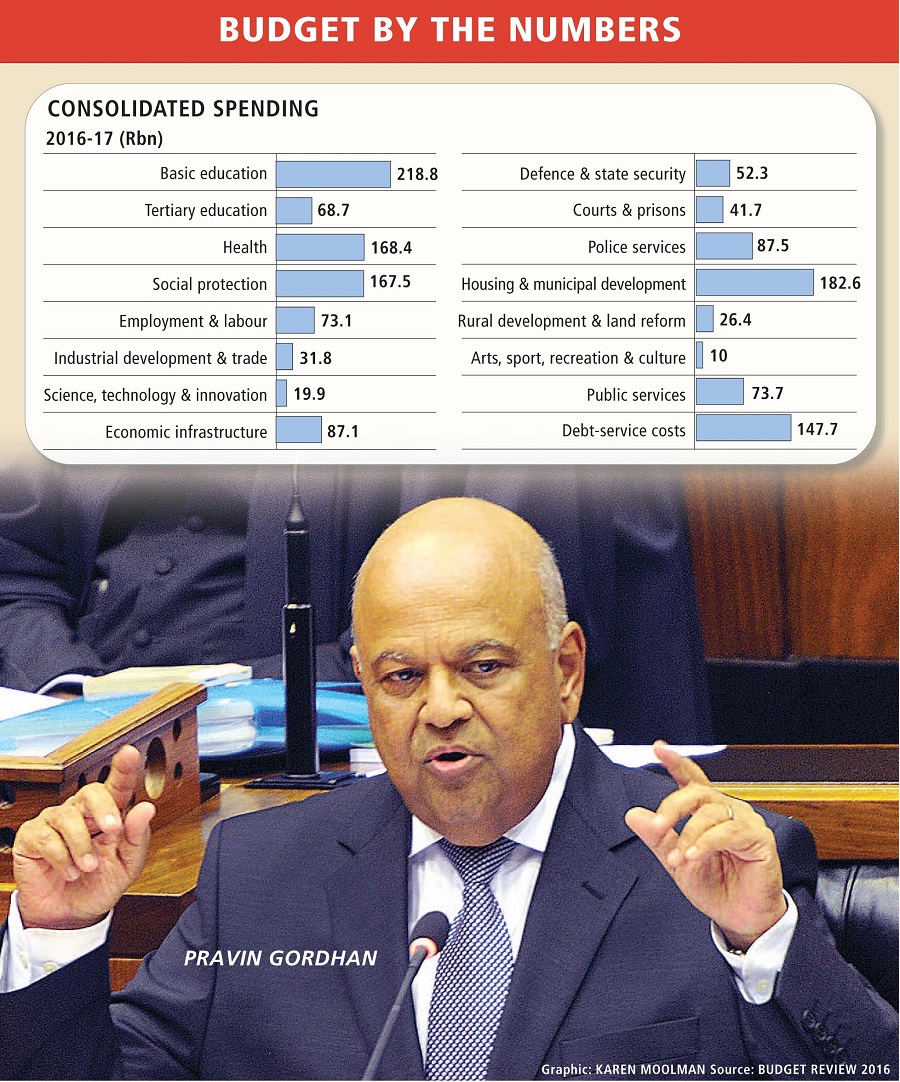

THE R1.5-trillion budget tabled by Finance Minister Pravin Gordhan on Wednesday will impose a heavier tax burden on high income earners, and is only the start of a tough three years as the government battles to ward off a credit-rating downgrade, address falling revenues and reignite economic growth.

Other measures include a higher fuel levy, higher alcohol and tobacco taxes and a lower rate of growth in government spending this year, which has enabled the Treasury to fill the holes left in its budget by lower revenue collection.

The real pain will come in later years, as the Treasury plans to reduce the budget deficit at a faster pace than previously projected from next year. This will be achieved by limiting growth of the public sector wage bill and imposing tax increases amounting to R18bn this year and R30bn in 2017-18 and 2018-19 combined.

Public sector employment will be frozen from April. Through attrition, the removal of vacant posts, retrenchments, early retirement and voluntary severance packages, the government hopes to reduce the number of public servants by 20,000 and its wage bill by R7.2bn over the next three years.

The 2016-17 tax increases will be implemented over a broad base but higher-income taxpayers will bear the brunt, being compensated for only about 60% of fiscal drag. This means they will pay more tax. Fiscal drag is the effect of inflation, which pushes taxpayers into higher tax brackets.

Mr Gordhan emphasised the need to foster economic growth and for all sectors of society to "unite as a team" behind a common effort to pull the country out of the doldrums. "We are resolved to restore the momentum of growth," he said.

The government’s infrastructure programme is expected to contribute to this growth: the public sector will invest R870bn in transport, energy, housing, health and water infrastructure over the next three years.

The other main focus of the budget is on fiscal consolidation, aimed at stabilising debt as a percentage of gross domestic product (GDP) by means of more ambitious budget-deficit targets, reduced spending plans and tax increases.

The pace of fiscal consolidation has accelerated dramatically, with the budget deficit projected to fall to 3.2% in 2016-17, 2.8% in 2017-18 and 2.4% in 2018-19 — much faster than the plan outlined in last year’s medium-term budget policy statement. The Treasury plans to achieve this through spending cuts of R10bn and tax increases of R15bn in 2017-18 and R15bn on each the following year.

Real growth in government noninterest spending is maintained at 0.2% this year but the expenditure ceiling is cut by R10bn in 2017-18 and R15bn in 2018-19, mainly by reducing the public sector wage bill. Over the next three years, government expenditure grows in real terms at an average of 0.8% a year. Government spending grew 2.2% in 2015-16.

Mr Gordhan emphasised at a media briefing before his speech that there would not be austerity and cuts of social grants and other essential services were not on the agenda. However, government programmes would be reviewed to see if they were necessary or whether their implementation could be delayed.

A reprioritisation of R31.8bn in allocations has been made over the next three years to cover the needs of higher education, the drought and the government’s commitment to the New Development Bank.

Mr Gordhan announced a series of measures to cut government spending. Savings on the purchase of goods and services of R5bn are anticipated over the next three years, while he also announced restrictions on managerial and administrative vacancies; reduced transfers for the operating budgets of public entities; a new national travel and accommodation policy and limitations on conference costs; and new guidelines to limit the cost of motor vehicles purchased for political office-bearers.

The general fuel levy rises 30c/l, raising R6.8bn more for the fiscus. Increases of 6%-8.5% in the duties on alcoholic beverages and tobacco products will be imposed, raising an additional R1.5bn and R767m respectively. The effective capital gains tax for individuals will rise from 13.7% to 16.4% and for companies from 18.6% to 22.4%. A new tax on sugar-sweetened beverages will be introduced on April 1 next year in a bid to reduce "excessive sugar intake".

Tax revenue of R1.3-trillion as a percentage of GDP is projected to be 30.2% in 2016-17. Tax revenue fell R4bn short for 2015-16 compared with projections. No provision is made for more guarantees for South African Airways (SAA), but the South African Post Office has been allocated R650m in 2016-17 for recapitalisation.

Mr Gordhan said he and Public Enterprises Minister Lynne Brown had agreed to explore the possible merger of SAA and SA Express and look for a potential minority equity partner. Unnecessary state-owned entities would be phased out.

Pravin Gordhan delivers his speech. Picture: TREVOR SAMSON

THE R1.5-trillion budget tabled by Finance Minister Pravin Gordhan on Wednesday will impose a heavier tax burden on high income earners, and is only the start of a tough three years as the government battles to ward off a credit-rating downgrade, address falling revenues and reignite economic growth.

Other measures include a higher fuel levy, higher alcohol and tobacco taxes and a lower rate of growth in government spending this year, which has enabled the Treasury to fill the holes left in its budget by lower revenue collection.

The real pain will come in later years, as the Treasury plans to reduce the budget deficit at a faster pace than previously projected from next year. This will be achieved by limiting growth of the public sector wage bill and imposing tax increases amounting to R18bn this year and R30bn in 2017-18 and 2018-19 combined.

Public sector employment will be frozen from April. Through attrition, the removal of vacant posts, retrenchments, early retirement and voluntary severance packages, the government hopes to reduce the number of public servants by 20,000 and its wage bill by R7.2bn over the next three years.

The 2016-17 tax increases will be implemented over a broad base but higher-income taxpayers will bear the brunt, being compensated for only about 60% of fiscal drag. This means they will pay more tax. Fiscal drag is the effect of inflation, which pushes taxpayers into higher tax brackets.

Mr Gordhan emphasised the need to foster economic growth and for all sectors of society to "unite as a team" behind a common effort to pull the country out of the doldrums. "We are resolved to restore the momentum of growth," he said.

The government’s infrastructure programme is expected to contribute to this growth: the public sector will invest R870bn in transport, energy, housing, health and water infrastructure over the next three years.

The other main focus of the budget is on fiscal consolidation, aimed at stabilising debt as a percentage of gross domestic product (GDP) by means of more ambitious budget-deficit targets, reduced spending plans and tax increases.

The pace of fiscal consolidation has accelerated dramatically, with the budget deficit projected to fall to 3.2% in 2016-17, 2.8% in 2017-18 and 2.4% in 2018-19 — much faster than the plan outlined in last year’s medium-term budget policy statement. The Treasury plans to achieve this through spending cuts of R10bn and tax increases of R15bn in 2017-18 and R15bn on each the following year.

Real growth in government noninterest spending is maintained at 0.2% this year but the expenditure ceiling is cut by R10bn in 2017-18 and R15bn in 2018-19, mainly by reducing the public sector wage bill. Over the next three years, government expenditure grows in real terms at an average of 0.8% a year. Government spending grew 2.2% in 2015-16.

Mr Gordhan emphasised at a media briefing before his speech that there would not be austerity and cuts of social grants and other essential services were not on the agenda. However, government programmes would be reviewed to see if they were necessary or whether their implementation could be delayed.

A reprioritisation of R31.8bn in allocations has been made over the next three years to cover the needs of higher education, the drought and the government’s commitment to the New Development Bank.

Mr Gordhan announced a series of measures to cut government spending. Savings on the purchase of goods and services of R5bn are anticipated over the next three years, while he also announced restrictions on managerial and administrative vacancies; reduced transfers for the operating budgets of public entities; a new national travel and accommodation policy and limitations on conference costs; and new guidelines to limit the cost of motor vehicles purchased for political office-bearers.

The general fuel levy rises 30c/l, raising R6.8bn more for the fiscus. Increases of 6%-8.5% in the duties on alcoholic beverages and tobacco products will be imposed, raising an additional R1.5bn and R767m respectively. The effective capital gains tax for individuals will rise from 13.7% to 16.4% and for companies from 18.6% to 22.4%. A new tax on sugar-sweetened beverages will be introduced on April 1 next year in a bid to reduce "excessive sugar intake".

Tax revenue of R1.3-trillion as a percentage of GDP is projected to be 30.2% in 2016-17. Tax revenue fell R4bn short for 2015-16 compared with projections. No provision is made for more guarantees for South African Airways (SAA), but the South African Post Office has been allocated R650m in 2016-17 for recapitalisation.

Mr Gordhan said he and Public Enterprises Minister Lynne Brown had agreed to explore the possible merger of SAA and SA Express and look for a potential minority equity partner. Unnecessary state-owned entities would be phased out.

News, views and analysis of Finance Minister Pravin Gordhan's 2016 budget

News, views and analysis of Finance Minister Pravin Gordhan's 2016 budget

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.34%

Change: 0.03%

Change: -0.10%

Change: -0.22%

Change: -0.69%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data