THREE years after Finance Minister Pravin Gordhan announced in his 2013 budget speech that the government would initiate a tax review, the tax committee headed by Judge Dennis Davis is starting work on a report on tax administration, which will look at whether SA has the appropriate institutions and infrastructure in place to implement the committee’s recommendations on tax policy.

This comes amid tension between Mr Gordhan and South African Revenue Service (SARS) commissioner Tom Moyane over Mr Moyane’s far-reaching plans to restructure SARS. However, Judge Davis says his committee always intended to review whether the SARS model, which was drawn up 20 years ago, is still appropriate for SA’s needs.

"We can’t second-guess the commissioner’s restructuring programme. But we can look at questions of institutional independence, and of whether SARS can meet the challenges of delivering on the proposals we are making," he says.

Among other things, the tax administration report will look at what will happen once the committee completes its work, which Judge Davis expects will be in about 18 months’ time. Some in the tax industry have speculated that it might become a standing committee on taxation, but it’s not clear that this is on the cards.

Judge Davis says there are three or four more reports to do and then the committee’s work will be completed. Seven interim reports have been published and the committee has already redrafted or revamped many of these in response to public comments and concerns.

Core to its work is what the judge calls the "normative framework" — the macroanalysis report that sets out the options for SA’s tax system in the light of the objectives of "inclusive growth, employment, development and fiscal sustainability" set out when the tax review was initiated.

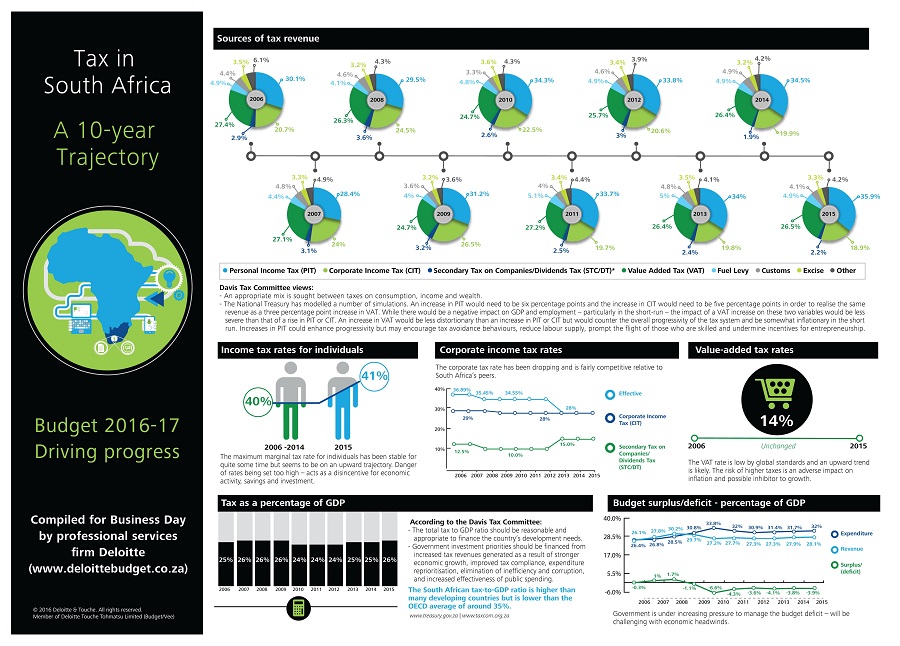

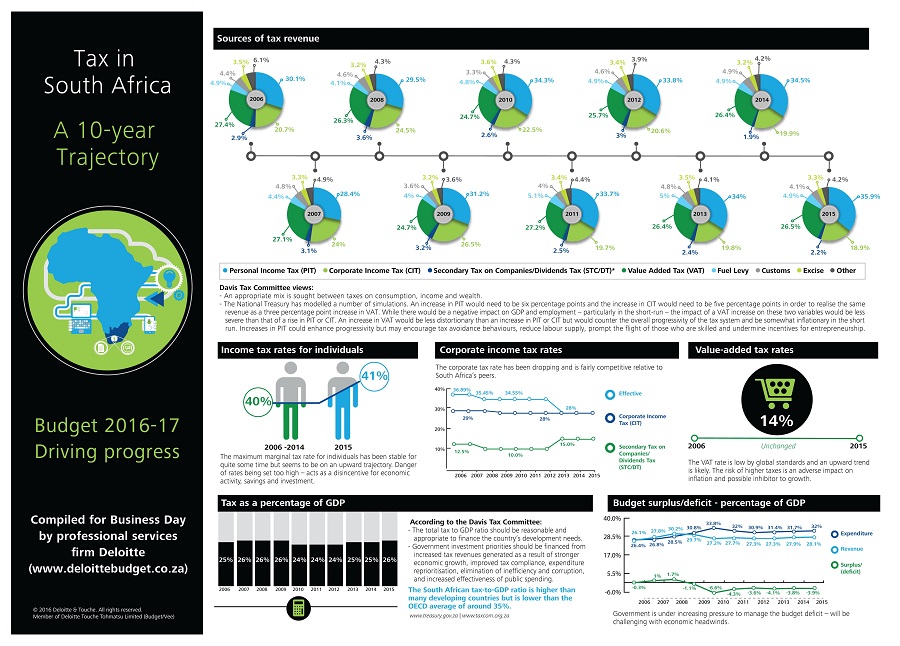

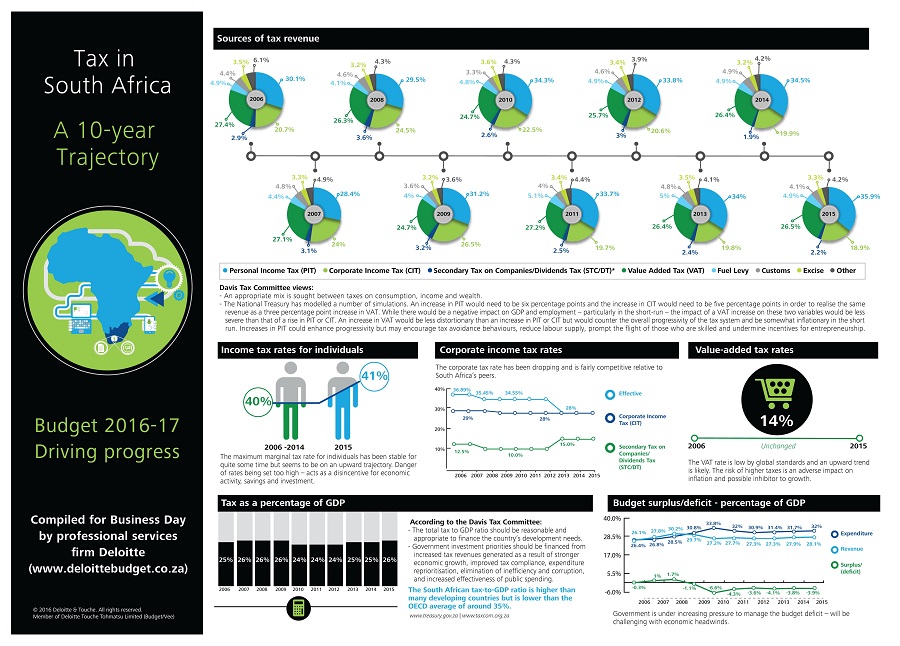

The interim macro-analysis report, and the interim report on value-added tax (VAT), prompted heated responses from the Congress of South African Trade Unions (Cosatu) when they were published last year, with Cosatu alleging that the committee was trying to prescribe to the government an increase in the VAT rate.

The committee countered with a media release emphasising that it had not prescribed an increase and clarifying the points in its report. It reiterated its findings: "It is evident that an increase in the present standard rate of VAT (14%) would be somewhat inflationary in the short run…. In contrast an increase in personal or corporate tax rates would be much less inflationary.

"While there would be a negative impact on real gross domestic product (GDP) and employment — particularly in the short run — the impact of a VAT increase on these two variables would be far less severe than that of a rise in personal or corporate income tax.

"It is thus clear that from a purely macroeconomic standpoint, an increase in VAT is less distortionary than an increase in indirect taxes."

The report went on to qualify this, however, noting that an increase in VAT would have more of an effect on inequality than increasing other taxes, and that "should it be necessary to increase the standard rate of VAT, it will be important for the fiscal authorities to think carefully about compensatory mechanisms for the poor".

Judge Davis says that in an economy growing at no more than 0.5%, each of the major taxes presents problems. Increasing VAT is the easiest way to raise extra revenue. In the short term, it does have retarding effects on GDP and it worsens inflation. "But it has got to be on the table," he says.

The committee has also revamped its interim report on small and medium-sized enterprises (SMEs). Judge Davis says the new version of the report on the taxation of SMEs has taken account of concerns that much of SA’s tax incentive system for smaller businesses tends to benefit "doctors and estate agents" rather than enterprises that really employ people.

The new report, he says, asks "how best we can use the tax system in its modest way to promote businesses which create employment".

The committee has also revamped its interim estate duty report, which attracted significant criticism. One of the things the committee was asked to look at was a wealth tax, as recommended by French economist Thomas Piketty. Meanwhile, the committee has estimated that more could and should be collected from estate duty by closing loopholes.

The committee has also reported to the finance minister on its views on the proposed carbon tax, which have been less than enthusiastic. "We are sympathetic to the objectives. But we don’t think the costs will be absorbed by the emitters, and we have no confidence that poorer people won’t bear more of the costs," the judge says.

"That is why we would prefer that the tax be zero-rated for a year so that the Treasury can come with a clear idea of the implications."

Still on the committee’s agenda are reports on tax incentives and corporate tax. It has completed a report on mining tax, which recommended a "steady as she goes" approach, and is working on a report on the taxation of nongovernmental organisations.

Among the other issues it has taken up is the much discussed question of a new tax and exchange control amnesty, along the lines of the last one announced in 2003. New measures in place from 2017-18 will require the exchange of tax information between countries around the world, so at that stage it will be possible for SA’s tax authorities to approach tax administrations in other jurisdictions if they suspect there are South African assets there that have not been disclosed.

Judge Davis says he has been inundated with approaches from people who claim that while smaller taxpayers came forward in the last amnesty, there are many larger ones who did not.

REPORT: Judge Dennis Davis says his tax review committee has started its report into the tax administration system, and its work should be done in about 18 months’ time. Picture: PUXLEY MAKGATHO

THREE years after Finance Minister Pravin Gordhan announced in his 2013 budget speech that the government would initiate a tax review, the tax committee headed by Judge Dennis Davis is starting work on a report on tax administration, which will look at whether SA has the appropriate institutions and infrastructure in place to implement the committee’s recommendations on tax policy.

This comes amid tension between Mr Gordhan and South African Revenue Service (SARS) commissioner Tom Moyane over Mr Moyane’s far-reaching plans to restructure SARS. However, Judge Davis says his committee always intended to review whether the SARS model, which was drawn up 20 years ago, is still appropriate for SA’s needs.

"We can’t second-guess the commissioner’s restructuring programme. But we can look at questions of institutional independence, and of whether SARS can meet the challenges of delivering on the proposals we are making," he says.

Among other things, the tax administration report will look at what will happen once the committee completes its work, which Judge Davis expects will be in about 18 months’ time. Some in the tax industry have speculated that it might become a standing committee on taxation, but it’s not clear that this is on the cards.

Judge Davis says there are three or four more reports to do and then the committee’s work will be completed. Seven interim reports have been published and the committee has already redrafted or revamped many of these in response to public comments and concerns.

Core to its work is what the judge calls the "normative framework" — the macroanalysis report that sets out the options for SA’s tax system in the light of the objectives of "inclusive growth, employment, development and fiscal sustainability" set out when the tax review was initiated.

The interim macro-analysis report, and the interim report on value-added tax (VAT), prompted heated responses from the Congress of South African Trade Unions (Cosatu) when they were published last year, with Cosatu alleging that the committee was trying to prescribe to the government an increase in the VAT rate.

The committee countered with a media release emphasising that it had not prescribed an increase and clarifying the points in its report. It reiterated its findings: "It is evident that an increase in the present standard rate of VAT (14%) would be somewhat inflationary in the short run…. In contrast an increase in personal or corporate tax rates would be much less inflationary.

"While there would be a negative impact on real gross domestic product (GDP) and employment — particularly in the short run — the impact of a VAT increase on these two variables would be far less severe than that of a rise in personal or corporate income tax.

"It is thus clear that from a purely macroeconomic standpoint, an increase in VAT is less distortionary than an increase in indirect taxes."

The report went on to qualify this, however, noting that an increase in VAT would have more of an effect on inequality than increasing other taxes, and that "should it be necessary to increase the standard rate of VAT, it will be important for the fiscal authorities to think carefully about compensatory mechanisms for the poor".

Judge Davis says that in an economy growing at no more than 0.5%, each of the major taxes presents problems. Increasing VAT is the easiest way to raise extra revenue. In the short term, it does have retarding effects on GDP and it worsens inflation. "But it has got to be on the table," he says.

The committee has also revamped its interim report on small and medium-sized enterprises (SMEs). Judge Davis says the new version of the report on the taxation of SMEs has taken account of concerns that much of SA’s tax incentive system for smaller businesses tends to benefit "doctors and estate agents" rather than enterprises that really employ people.

The new report, he says, asks "how best we can use the tax system in its modest way to promote businesses which create employment".

The committee has also revamped its interim estate duty report, which attracted significant criticism. One of the things the committee was asked to look at was a wealth tax, as recommended by French economist Thomas Piketty. Meanwhile, the committee has estimated that more could and should be collected from estate duty by closing loopholes.

The committee has also reported to the finance minister on its views on the proposed carbon tax, which have been less than enthusiastic. "We are sympathetic to the objectives. But we don’t think the costs will be absorbed by the emitters, and we have no confidence that poorer people won’t bear more of the costs," the judge says.

"That is why we would prefer that the tax be zero-rated for a year so that the Treasury can come with a clear idea of the implications."

Still on the committee’s agenda are reports on tax incentives and corporate tax. It has completed a report on mining tax, which recommended a "steady as she goes" approach, and is working on a report on the taxation of nongovernmental organisations.

Among the other issues it has taken up is the much discussed question of a new tax and exchange control amnesty, along the lines of the last one announced in 2003. New measures in place from 2017-18 will require the exchange of tax information between countries around the world, so at that stage it will be possible for SA’s tax authorities to approach tax administrations in other jurisdictions if they suspect there are South African assets there that have not been disclosed.

Judge Davis says he has been inundated with approaches from people who claim that while smaller taxpayers came forward in the last amnesty, there are many larger ones who did not.

News, views and analysis of Finance Minister Pravin Gordhan's 2016 budget

News, views and analysis of Finance Minister Pravin Gordhan's 2016 budget

Change: -0.47%

Change: -0.57%

Change: -1.76%

Change: -0.34%

Change: 0.02%

Data supplied by Profile Data

Change: -1.49%

Change: 0.08%

Change: -0.47%

Change: 0.00%

Change: -0.04%

Data supplied by Profile Data

Change: -0.34%

Change: 0.03%

Change: -0.10%

Change: -0.22%

Change: -0.69%

Data supplied by Profile Data

Change: -0.28%

Change: -1.15%

Change: -0.07%

Change: -1.21%

Change: -0.22%

Data supplied by Profile Data