Consumer inflation ticks up but beats expectations

by Staff Writer,

2014-01-22 10:53:50.0

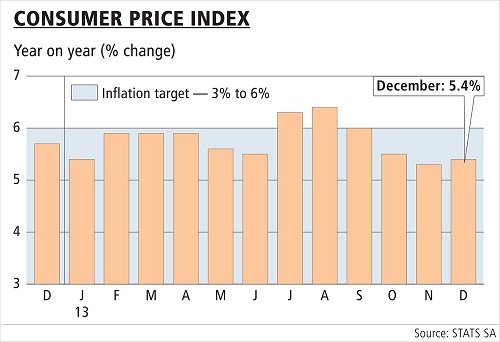

SOUTH Africa’s consumer price index (CPI)‚ used to measure inflation‚ increased to 5.4% year on year in December from a 5.3% year-on-year increase the prior month‚ Statistics South Africa said on Wednesday.

Consumers have been warned to expect higher inflation this year as the weaker rand’s effects on imports are set to be more pronounced. Higher inflation reduces the buying power of disposable incomes and offsets the benefits of 40-year-low interest rates.

Inflation had been expected to accelerate to 5.5% year on year last month‚ according to a BDlive survey of 13 leading economists, whose forecasts ranged from 5.3% to 5.6%.

Ilke van Zyl, an economist at Vunani Securities, said: "CPI was a bit lower than our expectations. We did indicate to clients there was a slight risk of undershooting in December due to variable food prices. Petrol prices and rentals rose in the month, putting upward pressure on the CPI.

"We expect food prices to remain low for the next two months, after which they may rise sharply as the effects of the drought are felt. This will not give the Reserve Bank room to lower rates, with the first hike expected at year-end."

Food prices are seen as having put less pressure on inflation, although this is expected to change in the months ahead. This is because the rand has weakened drastically recently, raising the prices of key commodities such as maize and fuel.

Theuns de Wet, head of global research at Rand Merchant Bank, agreed the "surprise" CPI figure was mostly due to lower than expected food prices.

"From an interest rate perspective, the smaller than expected rise in headline inflation (of 5.4%) and the fact that core inflation remained unchanged year on year at 5.3% are more supportive of an unchanged interest rate environment for now," he said.

CPI was 0.3% higher month on month in December, from a 0.1% month on month rise in November.

A month-on-month decline in food prices had benefited headline CPI, said Elize Kruger, an economist at Kadd Capital. "But this is possibly the last favourable food price print we will see as the impact of the rand depreciation and higher maize prices will be felt in the next six to nine months."

Inflation averaged 5.7% last year, compared with 5.6% in 2012, 5% in 2011 and 4.3% in 2010. That still placed it within the Reserve Bank’s 3%-6% target range.

Looking ahead, Nomura emerging-markets economist Peter Attard Montalto said there was still the risk of a breach of the Bank’s range in March this year for one month.

"Overall we don’t think the numbers today (given the rand and raw maize prices) will be enough to surprise the Bank or alter the monetary policy committee being hawkish next week," Mr Attard Montalto said.

With Ntsakisi Maswanganyi

Picture: THINKSTOCK

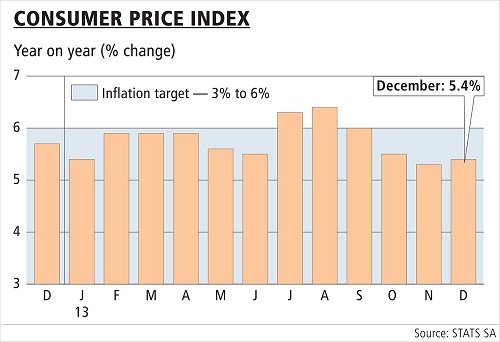

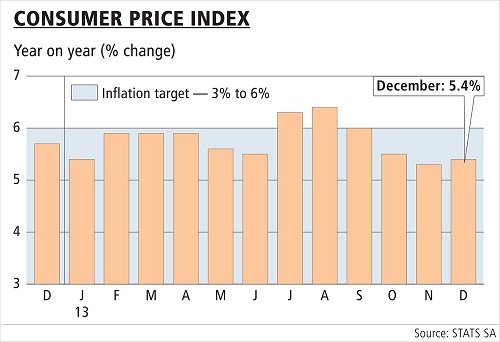

SOUTH Africa’s consumer price index (CPI)‚ used to measure inflation‚ increased to 5.4% year on year in December from a 5.3% year-on-year increase the prior month‚ Statistics South Africa said on Wednesday.

Consumers have been warned to expect higher inflation this year as the weaker rand’s effects on imports are set to be more pronounced. Higher inflation reduces the buying power of disposable incomes and offsets the benefits of 40-year-low interest rates.

Inflation had been expected to accelerate to 5.5% year on year last month‚ according to a BDlive survey of 13 leading economists, whose forecasts ranged from 5.3% to 5.6%.

Ilke van Zyl, an economist at Vunani Securities, said: "CPI was a bit lower than our expectations. We did indicate to clients there was a slight risk of undershooting in December due to variable food prices. Petrol prices and rentals rose in the month, putting upward pressure on the CPI.

"We expect food prices to remain low for the next two months, after which they may rise sharply as the effects of the drought are felt. This will not give the Reserve Bank room to lower rates, with the first hike expected at year-end."

Food prices are seen as having put less pressure on inflation, although this is expected to change in the months ahead. This is because the rand has weakened drastically recently, raising the prices of key commodities such as maize and fuel.

Theuns de Wet, head of global research at Rand Merchant Bank, agreed the "surprise" CPI figure was mostly due to lower than expected food prices.

"From an interest rate perspective, the smaller than expected rise in headline inflation (of 5.4%) and the fact that core inflation remained unchanged year on year at 5.3% are more supportive of an unchanged interest rate environment for now," he said.

CPI was 0.3% higher month on month in December, from a 0.1% month on month rise in November.

A month-on-month decline in food prices had benefited headline CPI, said Elize Kruger, an economist at Kadd Capital. "But this is possibly the last favourable food price print we will see as the impact of the rand depreciation and higher maize prices will be felt in the next six to nine months."

Inflation averaged 5.7% last year, compared with 5.6% in 2012, 5% in 2011 and 4.3% in 2010. That still placed it within the Reserve Bank’s 3%-6% target range.

Looking ahead, Nomura emerging-markets economist Peter Attard Montalto said there was still the risk of a breach of the Bank’s range in March this year for one month.

"Overall we don’t think the numbers today (given the rand and raw maize prices) will be enough to surprise the Bank or alter the monetary policy committee being hawkish next week," Mr Attard Montalto said.

With Ntsakisi Maswanganyi

Register/Login

Close XMy News

You can only set up or view personalised news headlines when you are logged in as a registered user. Thereafter you can choose the sectors of industry in which you are interested, and the latest articles from those sectors will display in this area of your console.

Login or Register.Top Stories

My Watchlist

You can only set up or view your share watchlist when you are logged in as a registered user. Thereafter you can select a list of companies and enter your share details to monitor their performance.

Login or Register.My Clippings

You can only clip articles when you are logged in as a registered user. Thereafter you can click on the "Read later" icon at the top of an article to save it to this area of your console, where you can return to read it at any time.

Login or Register.Change: -1.21%

Change: -1.31%

Change: -1.11%

Change: -1.12%

Change: -2.16%

Data supplied by Profile Data

Change: 0.00%

Change: 0.00%

Change: -1.21%

Change: 0.00%

Change: 0.00%

Data supplied by Profile Data

Change: 0.00%

Change: 0.01%

Change: 0.02%

Change: 0.00%

Change: -0.10%

Data supplied by Profile Data

Change: 0.00%

Change: 0.00%

Change: 0.00%

Change: 0.00%

Change: 0.00%

Data supplied by Profile Data