SOUTH African Airways (SAA) is projecting to generate a R177m profit before interest and tax in the 2017-18 financial year, which would be a dramatic R720m improvement from the R543m loss expected for 2016-17.

The main driver of the expected gains is projected aircraft lease costs, which are forecast to remain relatively stable at R4bn in both years, while revenue is expected to rise 13% compared to the 12.6% increase in operating costs.

SAA has not yet released its 2014-15 financial results but the airline’s corporate plan tabled in Parliament on Monday shows that its operating performance improved by R358m in the nine months to the end of December. In 2013-14, operating costs amounted to R30.6bn, totally wiping out revenue.

Finance Minister Pravin Gordhan last month asked Parliament to provide him with a month’s extension for the tabling of the SAA annual report so that provision could be made for its ongoing financial viability. The report was due to be tabled today. Mr Gordhan said previously that he wished to present a comprehensive plan for the airline at the same time that he tabled the report.

The corporate plan noted that the profit projection would result from "the combined effect of the elimination of the loss-making routes, a reprieve in oil prices (although somewhat offset by currency weakness) and an increased sales effort."

It noted that SAA had reduced its unit costs 17% over the last three years, saving R2.1bn despite a 46% deterioration in the value of the rand and inflationary pressures. A further R1.1bn in savings is forecast for the next three years.

Regarding its financing plans, SAA envisages capital market funding resulting from its government guarantee. It wants to issue bonds and commercial paper, and raise loans out of the domestic medium-term note programme, though SAA conceded that "the risk around the (government) guarantee first needs to be addressed". The government has provided SAA with total guarantees of R14.4bn.

The assumptions used for its profit forecasts include a rand-dollar exchange rate of R16.28, an oil price of $35 a barrel, continued reduction in costs and achieving higher revenue.

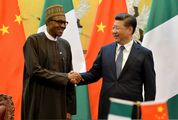

Picture: SUNDAY TIMES

SOUTH African Airways (SAA) is projecting to generate a R177m profit before interest and tax in the 2017-18 financial year, which would be a dramatic R720m improvement from the R543m loss expected for 2016-17.

The main driver of the expected gains is projected aircraft lease costs, which are forecast to remain relatively stable at R4bn in both years, while revenue is expected to rise 13% compared to the 12.6% increase in operating costs.

SAA has not yet released its 2014-15 financial results but the airline’s corporate plan tabled in Parliament on Monday shows that its operating performance improved by R358m in the nine months to the end of December. In 2013-14, operating costs amounted to R30.6bn, totally wiping out revenue.

Finance Minister Pravin Gordhan last month asked Parliament to provide him with a month’s extension for the tabling of the SAA annual report so that provision could be made for its ongoing financial viability. The report was due to be tabled today. Mr Gordhan said previously that he wished to present a comprehensive plan for the airline at the same time that he tabled the report.

The corporate plan noted that the profit projection would result from "the combined effect of the elimination of the loss-making routes, a reprieve in oil prices (although somewhat offset by currency weakness) and an increased sales effort."

It noted that SAA had reduced its unit costs 17% over the last three years, saving R2.1bn despite a 46% deterioration in the value of the rand and inflationary pressures. A further R1.1bn in savings is forecast for the next three years.

Regarding its financing plans, SAA envisages capital market funding resulting from its government guarantee. It wants to issue bonds and commercial paper, and raise loans out of the domestic medium-term note programme, though SAA conceded that "the risk around the (government) guarantee first needs to be addressed". The government has provided SAA with total guarantees of R14.4bn.

The assumptions used for its profit forecasts include a rand-dollar exchange rate of R16.28, an oil price of $35 a barrel, continued reduction in costs and achieving higher revenue.

Change: 1.35%

Change: 1.55%

Change: 0.96%

Change: 1.04%

Change: 3.65%

Data supplied by Profile Data

Change: 0.68%

Change: 0.94%

Change: 1.35%

Change: 0.00%

Change: 0.97%

Data supplied by Profile Data

Change: 0.25%

Change: 0.14%

Change: 0.00%

Change: 0.22%

Change: 0.11%

Data supplied by Profile Data

Change: -0.53%

Change: -0.60%

Change: -0.87%

Change: 0.18%

Change: -0.81%

Data supplied by Profile Data