Astral chooses to take the acquisitive route

by Marc Hasenfuss,

2016-02-12 05:54:54.0

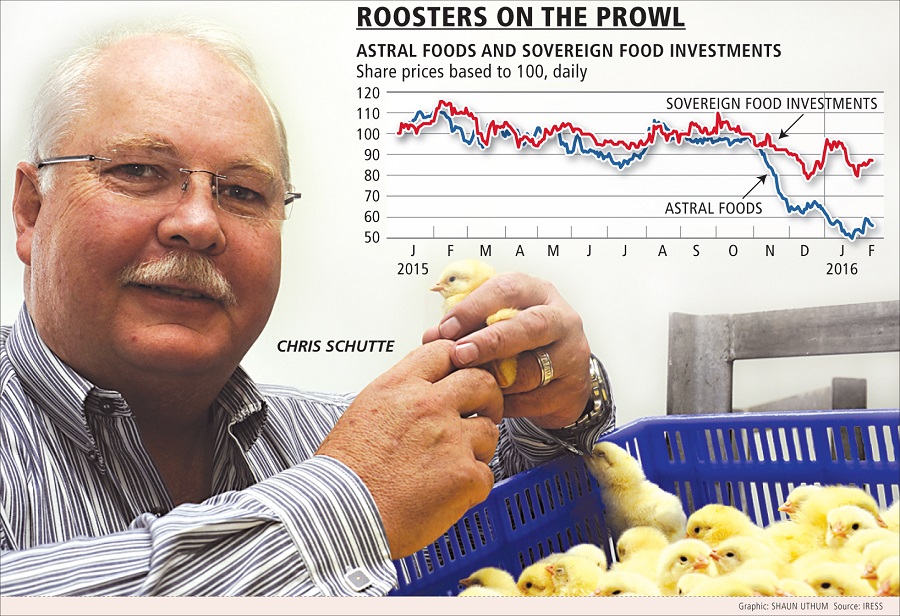

ASTRAL Foods, the "big bird" of the local poultry sector, is on the prowl for acquisitions that will boost growth but warned hostile takeover attempts would not fly.

Responding to questions at an annual meeting on Thursday, Astral CEO Chris Schutte reiterated the company’s determination to remain a pure poultry business. "If we want to remain a pure poultry play then we have to look at growth opportunities … especially if acquisitions are cheaper than our own expansion," he said.

Astral has repeatedly been linked to a possible tilt at smaller Eastern Cape rival Sovereign Food Investments, which trades at a substantial discount to its tangible net asset value (NAV).

But Mr Schutte indicated Sovereign was one of several sizeable poultry players that Astral would keep on its radar.

"Are we interested in buying Sovereign? It’s difficult to say ‘no’. If it’s not on our radar screen then we can’t really make a statement that we are a pure poultry player. We have to look for opportunities for mergers or acquisitions."

But Mr Schutte said it would be difficult to embark on a hostile takeover as Astral’s position as the biggest player in the local poultry sector would draw the attention of the competition authorities.

He argued that a "scheme of arrangement" would be the appropriate avenue to approach a takeover. "This would give us an opportunity to do a due diligence. We could drill down into marketing functions and distribution arrangements. With a hostile takeover there will be no chance to do a due diligence, and you can burn your fingers."

A Sovereign shareholder that had given an irrevocable undertaking to support that company’s empowerment scheme had approached Astral with an offer to sell their shares. "We would not do it because it would be construed as hostile," he said.

Mr Schutte also expressed reservations about a tilt at Sovereign, noting that only about 30% of its production was distributed in the Eastern Cape with the balance transported to the Western Cape and Gauteng. "Could we not make up those production numbers (in the Western Cape and Gauteng) simply by adding an extra shift?" he asked.

He also noted Sovereign had spent R120m on a loss-making production plant in Gauteng that would be a drain on their cash and not offer an attractive payback due to the torrid times befalling the poultry industry.

Mr Schutte stressed any approaches to other poultry players would be premised on Astral not overpaying for assets. "We will not look at net asset value … it means nothing when you are running a business. You can’t bank NAV — you bank income streams."

Mr Schutte said timing was of the essence in acquisitions with the poultry sector under pressure from higher input costs and imported chicken.

Speaking after the meeting, Vunani small to mid-cap analyst Anthony Clark said it was heartening to witness an "open, honest and transparent" engagement with shareholders. "It leaves me in no doubt Astral will survive the current crisis in the poultry sector, and emerge even stronger as the flock of poultry players gets thinned out."

Picture: THINKSTOCK

ASTRAL Foods, the "big bird" of the local poultry sector, is on the prowl for acquisitions that will boost growth but warned hostile takeover attempts would not fly.

Responding to questions at an annual meeting on Thursday, Astral CEO Chris Schutte reiterated the company’s determination to remain a pure poultry business. "If we want to remain a pure poultry play then we have to look at growth opportunities … especially if acquisitions are cheaper than our own expansion," he said.

Astral has repeatedly been linked to a possible tilt at smaller Eastern Cape rival Sovereign Food Investments, which trades at a substantial discount to its tangible net asset value (NAV).

But Mr Schutte indicated Sovereign was one of several sizeable poultry players that Astral would keep on its radar.

"Are we interested in buying Sovereign? It’s difficult to say ‘no’. If it’s not on our radar screen then we can’t really make a statement that we are a pure poultry player. We have to look for opportunities for mergers or acquisitions."

But Mr Schutte said it would be difficult to embark on a hostile takeover as Astral’s position as the biggest player in the local poultry sector would draw the attention of the competition authorities.

He argued that a "scheme of arrangement" would be the appropriate avenue to approach a takeover. "This would give us an opportunity to do a due diligence. We could drill down into marketing functions and distribution arrangements. With a hostile takeover there will be no chance to do a due diligence, and you can burn your fingers."

A Sovereign shareholder that had given an irrevocable undertaking to support that company’s empowerment scheme had approached Astral with an offer to sell their shares. "We would not do it because it would be construed as hostile," he said.

Mr Schutte also expressed reservations about a tilt at Sovereign, noting that only about 30% of its production was distributed in the Eastern Cape with the balance transported to the Western Cape and Gauteng. "Could we not make up those production numbers (in the Western Cape and Gauteng) simply by adding an extra shift?" he asked.

He also noted Sovereign had spent R120m on a loss-making production plant in Gauteng that would be a drain on their cash and not offer an attractive payback due to the torrid times befalling the poultry industry.

Mr Schutte stressed any approaches to other poultry players would be premised on Astral not overpaying for assets. "We will not look at net asset value … it means nothing when you are running a business. You can’t bank NAV — you bank income streams."

Mr Schutte said timing was of the essence in acquisitions with the poultry sector under pressure from higher input costs and imported chicken.

Speaking after the meeting, Vunani small to mid-cap analyst Anthony Clark said it was heartening to witness an "open, honest and transparent" engagement with shareholders. "It leaves me in no doubt Astral will survive the current crisis in the poultry sector, and emerge even stronger as the flock of poultry players gets thinned out."

Change: 2.48%

Change: 2.53%

Change: 2.08%

Change: 1.97%

Change: 5.33%

Data supplied by Profile Data

Change: 0.00%

Change: 0.00%

Change: 2.48%

Change: 0.00%

Change: 0.00%

Data supplied by Profile Data

Change: 0.44%

Change: 0.11%

Change: -0.76%

Change: -0.92%

Change: -0.23%

Data supplied by Profile Data

Change: 0.00%

Change: 0.00%

Change: 0.00%

Change: 0.00%

Change: 0.00%

Data supplied by Profile Data