SIBANYE Gold’s market capitalisation for the first time briefly surpassed that of Gold Fields, the former owner of its three major mines, as shareholders took a dim view of Gold Fields’ full-year loss and subdued outlook for the year ahead.

Gold Fields shares were pounded as much as 24% lower on Thursday, after it reported reduced production from its largest source of gold, Australia, where output will remain constrained for some time, and posted a swing to a full-year loss.

Focusing on its international portfolio and a single gold mine in SA, Gold Fields spun out three gold mines into newly formed Sibanye, which listed in 2013.

The 24% plunge in the Gold Fields share price to a session low of R50.05 meant that for the first time Sibanye’s market capitalisation at its own session low of R39.39bn was higher than Goldfield’s R38.95bn.

"If you think about it, Gold Fields got rid of the bulk of its rand-hedge assets and put them into Sibanye, which is now getting the full benefit of the rand’s weakness against the dollar with these high rand gold prices," said a market source, speaking on condition of anonymity.

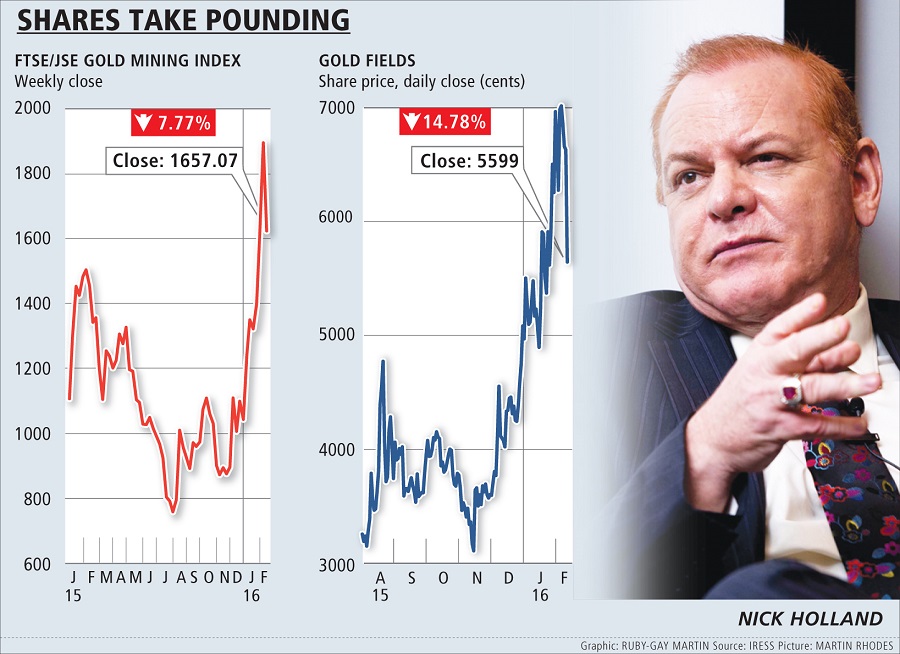

After losing more than 10% in intraday trade, the JSE gold mining index pared some losses towards the end low and closed 7.77% weaker.

While Gold Fields ended the day 15% down with a R43.6bn market cap against Sibanye’s R40.5bn market value, there was still clearly unhappiness at the news from the company.

Gold Fields’s declaration of a final 21 South African cents per share dividend did little to lift shareholders’ spirits after what had been a difficult year in which the company recorded $300m of impairments and reported a net loss of $242m compared with net earnings of $13m a year earlier.

Gold Fields said it expected to have production this year of between 2.05-million and 2.1-million ounces, down from the past year’s 2.16-million ounces.

The expected decline in gold from its international operations in Australia, Peru and Ghana would be offset by a 30% increase in output at the South Deep mine, south of Johannesburg, to 257,000 ounces.

The mine would break even towards the end of the year, said CEO Nick Holland.

With the rand gold price as high as it was, South Deep could reach breakeven sooner than that, said Nico Muller, the head of the South African division.

The market remained wary of promises about South Deep’s performance, given a series of missed targets and difficulties in reaching the mine’s potential.

"It implies more reliance on next year’s production on South Deep and I don’t think the market is too sure about what South Deep can consistently produce," Izak van Niekerk, a Cape Town-based analyst at Mergence Investment Managers, told Bloomberg.

"Management is promising clearer guidance on that mine in 2017 only."

Output in Australia, Gold Fields’ largest source of gold, will fall to 905,000 ounces from 988,000 ounces last year.

Being a large producer in Australia came at a cost, said Mr Holland. "A million ounces a year is a great target to have achieved, but you become a victim of your own success."

Gold Fields would spend $86m on exploring around its Australian mines for fresh resources, adding to the $90m it spent last year, he said.

It was also assessing its options at its Damang mine in Ghana, considering whether to extend the life of the open pit mine and what the consequences of its choices would be on the nearby Tarkwa mine, Mr Holland said.

Nick Holland. Picture: MARTIN RHODES

SIBANYE Gold’s market capitalisation for the first time briefly surpassed that of Gold Fields, the former owner of its three major mines, as shareholders took a dim view of Gold Fields’ full-year loss and subdued outlook for the year ahead.

Gold Fields shares were pounded as much as 24% lower on Thursday, after it reported reduced production from its largest source of gold, Australia, where output will remain constrained for some time, and posted a swing to a full-year loss.

Focusing on its international portfolio and a single gold mine in SA, Gold Fields spun out three gold mines into newly formed Sibanye, which listed in 2013.

The 24% plunge in the Gold Fields share price to a session low of R50.05 meant that for the first time Sibanye’s market capitalisation at its own session low of R39.39bn was higher than Goldfield’s R38.95bn.

"If you think about it, Gold Fields got rid of the bulk of its rand-hedge assets and put them into Sibanye, which is now getting the full benefit of the rand’s weakness against the dollar with these high rand gold prices," said a market source, speaking on condition of anonymity.

After losing more than 10% in intraday trade, the JSE gold mining index pared some losses towards the end low and closed 7.77% weaker.

While Gold Fields ended the day 15% down with a R43.6bn market cap against Sibanye’s R40.5bn market value, there was still clearly unhappiness at the news from the company.

Gold Fields’s declaration of a final 21 South African cents per share dividend did little to lift shareholders’ spirits after what had been a difficult year in which the company recorded $300m of impairments and reported a net loss of $242m compared with net earnings of $13m a year earlier.

Gold Fields said it expected to have production this year of between 2.05-million and 2.1-million ounces, down from the past year’s 2.16-million ounces.

The expected decline in gold from its international operations in Australia, Peru and Ghana would be offset by a 30% increase in output at the South Deep mine, south of Johannesburg, to 257,000 ounces.

The mine would break even towards the end of the year, said CEO Nick Holland.

With the rand gold price as high as it was, South Deep could reach breakeven sooner than that, said Nico Muller, the head of the South African division.

The market remained wary of promises about South Deep’s performance, given a series of missed targets and difficulties in reaching the mine’s potential.

"It implies more reliance on next year’s production on South Deep and I don’t think the market is too sure about what South Deep can consistently produce," Izak van Niekerk, a Cape Town-based analyst at Mergence Investment Managers, told Bloomberg.

"Management is promising clearer guidance on that mine in 2017 only."

Output in Australia, Gold Fields’ largest source of gold, will fall to 905,000 ounces from 988,000 ounces last year.

Being a large producer in Australia came at a cost, said Mr Holland. "A million ounces a year is a great target to have achieved, but you become a victim of your own success."

Gold Fields would spend $86m on exploring around its Australian mines for fresh resources, adding to the $90m it spent last year, he said.

It was also assessing its options at its Damang mine in Ghana, considering whether to extend the life of the open pit mine and what the consequences of its choices would be on the nearby Tarkwa mine, Mr Holland said.

Change: 0.54%

Change: 0.51%

Change: 1.60%

Change: 0.04%

Change: 1.02%

Data supplied by Profile Data

Change: 1.10%

Change: 0.20%

Change: 0.54%

Change: 0.00%

Change: 0.28%

Data supplied by Profile Data

Change: -1.87%

Change: -0.53%

Change: -0.53%

Change: -0.51%

Change: -1.80%

Data supplied by Profile Data

Change: -0.15%

Change: 1.05%

Change: 0.85%

Change: 0.93%

Change: 5.39%

Data supplied by Profile Data