ANALYSTS say that Bidvest’s decision to list its Foodservice and South African businesses separately is a sensible one. Most compellingly, Dirk van Vlaanderen, an investment analyst at Kagiso Asset Management, says it is the "most orderly way" for group CEO Brian Joffe to let go of the reins.

Bidvest’s decentralised structure has encouraged "strong divisional leadership", Mr van Vlaanderen says.

This is most evident in Bernard Berson running Foodservice and Lindsay Ralphs heading up the South African businesses. It permeates all levels of management.

Mr Joffe’s deal-making skills and strategic thinking have been complemented with "excellent execution at the divisional levels".

This means that both Foodservice and the South African operations "have strong leadership and are of sufficient scale to stand alone".

"Therefore, we believe the time was right for Mr Joffe to step down and solve the Bidvest group succession debate by empowering the two businesses to forge their independent futures," Mr van Vlaanderen says.

Mr Joffe’s involvement in the boards of both companies after they separate will be a positive move, given the experience and strategic direction he will continue to bring to both boards, Mr van Vlaanderen says.

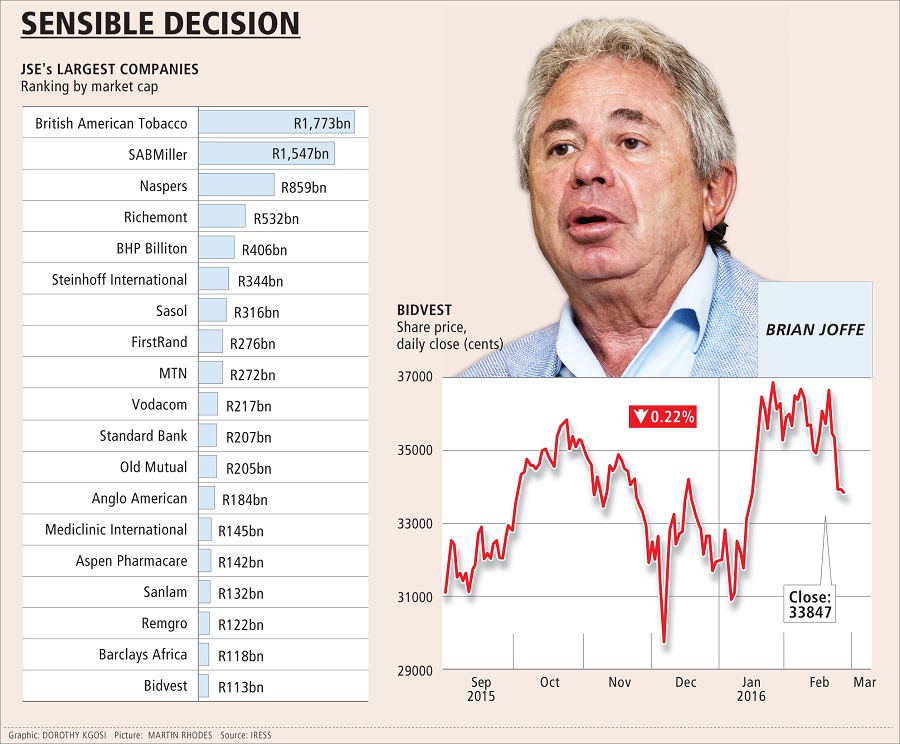

Meanwhile, Stephen Meintjes, an analyst at Momentum SP Reid Securities, says that emerging markets stocks, including South African stocks, have not been "flavour of the month" with global investors of late.

However, there is "clearly a strong appetite locally for JSE companies with successfully established operations offshore".

In October, Bidvest indicated it would restructure business operations into three distinct and independent companies, each with its own statutory board of directors, comprising senior executive management and independent directors.

The companies are Bidvest Industrial Holdings, housing the Bidvest SA division and the interest in Bidvest Namibia; Bidvest Foodservice International, housing the international and local food service operations; and Bidvest Capital. The last houses the South African property portfolio and investments in companies in which the group does not own majority stakes or exercise management control, such as Adcock Ingram Holdings.

The group will report its financial results reflecting the new structure for the financial year ending-June.

The group says the restructuring will streamline operations; make for greater transparency; improve management focus; and enable respective management teams to express their entrepreneurial flair and take direct responsibility for the growth of their companies. The Bidvest Group board will be reconstituted under the chairmanship of Lorato Phalatse, to manage the underlying structure.

In October, the company said that Mr Joffe would remain CEO, with David Cleasby as chief financial officer. Mr Joffe’s main focus would be to drive the overall strategy and acquisition activities of the group.

"The full composition of the restructured board and respective committees will be announced in due course," the group said.

Ms Phalatse says the reorganisation will better position Bidvest to take advantage of the "significant opportunities" in various parts of the world.

The board will continue to drive overall strategy, while guiding financial, treasury, compliance, governance, stakeholder communication, corporate finance, and other activities.

"We don’t necessarily believe the separation will unlock significant value, as we believe the market is already implying a fair value for the South African business and a high valuation (of) the Foodservice business — in line with global peers," Mr van Vlaanderen says. "The timing of the deal is good for Foodservice, given its current growth trajectory, but tough for the South African business, which is facing several headwinds across many of its businesses," he says.

He says Foodservices will initially be listed on the JSE, but believes the plan is to seek an international listing over time. "London could be a possibility," Mr van Vlaanderen says.

"The Foodservice business will likely continue to execute on its organic and acquisition-led strategy and we believe the growth prospects for this business remain attractive," he says.

"We also highlight that as a stand-alone business, it is hard to ignore the possibility that Foodservice could itself be acquired by one of its larger international food service peers, given its unique global footprint and good earnings prospects."

Mark Hodgson, industry analyst at Avior Capital Markets, says a Johannesburg listing does take Bidvest forward in terms of separately listing the food service business.

It unlocks the value of food services for shareholders, "including potentially putting the food services business in play", he says.

"With the historic combined Bidvest Group — with a single share price entry point — it was much more difficult to establish the value the market was putting on each of the pieces. So, the food-services listing clarifies the value the market is placing on the food services business and provides more investor choice," he says.

But that there is a risk, he also says, that the largely South African industrial business may be "less compelling" for investors in the short term, and consequently may unlock less overall value. However, a listing on the JSE is, less complex, and less costly.

"Initially, the market has received this news positively and it is positive in terms of group evolution and more options (being) available," Mr Hodgson says. "Since then, the market price of Bidvest has fallen back, which indicates more caution being shown by investors."

Change: 0.40%

Change: 0.47%

Change: -0.49%

Change: 0.53%

Change: 1.03%

Data supplied by Profile Data

Change: 1.71%

Change: 1.28%

Change: 0.40%

Change: 0.00%

Change: 1.64%

Data supplied by Profile Data

Change: -1.27%

Change: 0.00%

Change: 0.05%

Change: -0.08%

Change: 0.35%

Data supplied by Profile Data

Change: -0.02%

Change: 0.21%

Change: -0.06%

Change: 0.53%

Change: 0.70%

Data supplied by Profile Data