SANLAM’S black economic empowerment (BEE) partner Ubuntu-Botho paid a special dividend of R830m to shareholders, underscoring the ongoing success of the 12-year partnership.

Ubuntu-Botho is headed by businessman Patrice Motsepe and is 55%-owned by Sizanani-Thusanang-Helpmekaar Investments, a company owned by Mr Motsepe and his family.

This means about R456m of the special dividend last year was due to Mr Motsepe’s Sizanani-Thusanang-Helpmekaar company, based on its 55% shareholding in Ubuntu-Botho.

"In 2015, Sanlam enabled UB (Ubuntu-Botho) to pay a special dividend of R830m to its shareholders," Sanlam’s latest sustainability report showed.

Other Ubuntu-Botho shareholders include Abafazi Basadi Ubuntu-Botho-Investments, the Ubuntu-Botho Women’s Upliftment Trust and trade unions, such as the National Education Health and Allied Workers’ Union, and the South African Democratic Teachers’ Union.

Ubuntu-Botho holds about 292.4-million shares (about 13.5% of the entire issued share capital) in Sanlam, valued at about R18.7bn based on the insurer’s share price of slightly more than R63.94 last week.

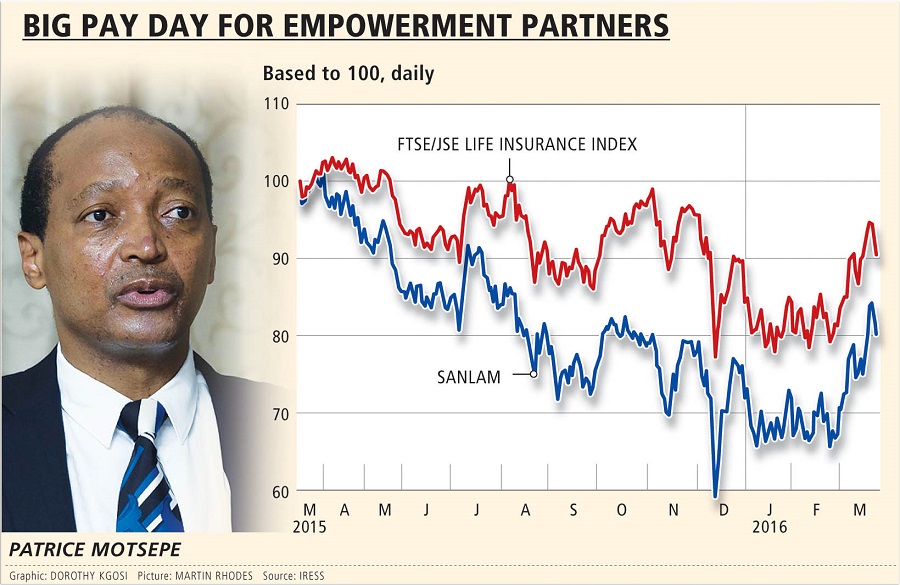

Last year, the Ubuntu-Botho shares in Sanlam were valued at about R23bn, but Sanlam’s share price has pulled back from a high of about R80.

The Sanlam deal with Ubuntu-Botho is the most successful empowerment deal in SA’s insurance sector.

As far as the financial services sector is concerned, only FirstRand’s BEE deal can compete with it when it comes to value creation.

When the Sanlam BEE deal matured in 2013, Ubuntu-Botho’s shares were valued at about R15.2bn.

Ubuntu-Botho initially bought 226-million Sanlam shares in 2004, and the deal was funded through a capital investment of R200m by Mr Motsepe and close to R1.2bn in debt.

In the 10-year period of the BEE deal, Sanlam paid Ubuntu-Botho enough dividends to settle the debt. In 2007, Ubuntu-Botho paid a R50m dividend to shareholders. After the deal matured in 2013, Sanlam and Ubuntu-Botho extended the partnership for a further 10 years.

Sanlam has committed to helping Mr Motsepe fulfil his ambition of creating an independent black-owned financial services company.

Working with former Sanlam CEO Johan van Zyl, Mr Motsepe has created African Rainbow Capital, a 100%-owned subsidiary of Ubuntu-Botho.

Earlier in the year, the Competition Tribunal approved a joint investment by African Rainbow Capital and Sanlam to buy Indwe Broker Holdings.

When the deal was approved, Sanlam CEO Ian Kirk said Indwe was the largest South African-based short-term insurance broker outside internationals such as Marsh.

Picture: THINKSTOCK

SANLAM’S black economic empowerment (BEE) partner Ubuntu-Botho paid a special dividend of R830m to shareholders, underscoring the ongoing success of the 12-year partnership.

Ubuntu-Botho is headed by businessman Patrice Motsepe and is 55%-owned by Sizanani-Thusanang-Helpmekaar Investments, a company owned by Mr Motsepe and his family.

This means about R456m of the special dividend last year was due to Mr Motsepe’s Sizanani-Thusanang-Helpmekaar company, based on its 55% shareholding in Ubuntu-Botho.

"In 2015, Sanlam enabled UB (Ubuntu-Botho) to pay a special dividend of R830m to its shareholders," Sanlam’s latest sustainability report showed.

Other Ubuntu-Botho shareholders include Abafazi Basadi Ubuntu-Botho-Investments, the Ubuntu-Botho Women’s Upliftment Trust and trade unions, such as the National Education Health and Allied Workers’ Union, and the South African Democratic Teachers’ Union.

Ubuntu-Botho holds about 292.4-million shares (about 13.5% of the entire issued share capital) in Sanlam, valued at about R18.7bn based on the insurer’s share price of slightly more than R63.94 last week.

Last year, the Ubuntu-Botho shares in Sanlam were valued at about R23bn, but Sanlam’s share price has pulled back from a high of about R80.

The Sanlam deal with Ubuntu-Botho is the most successful empowerment deal in SA’s insurance sector.

As far as the financial services sector is concerned, only FirstRand’s BEE deal can compete with it when it comes to value creation.

When the Sanlam BEE deal matured in 2013, Ubuntu-Botho’s shares were valued at about R15.2bn.

Ubuntu-Botho initially bought 226-million Sanlam shares in 2004, and the deal was funded through a capital investment of R200m by Mr Motsepe and close to R1.2bn in debt.

In the 10-year period of the BEE deal, Sanlam paid Ubuntu-Botho enough dividends to settle the debt. In 2007, Ubuntu-Botho paid a R50m dividend to shareholders. After the deal matured in 2013, Sanlam and Ubuntu-Botho extended the partnership for a further 10 years.

Sanlam has committed to helping Mr Motsepe fulfil his ambition of creating an independent black-owned financial services company.

Working with former Sanlam CEO Johan van Zyl, Mr Motsepe has created African Rainbow Capital, a 100%-owned subsidiary of Ubuntu-Botho.

Earlier in the year, the Competition Tribunal approved a joint investment by African Rainbow Capital and Sanlam to buy Indwe Broker Holdings.

When the deal was approved, Sanlam CEO Ian Kirk said Indwe was the largest South African-based short-term insurance broker outside internationals such as Marsh.

Change: 1.37%

Change: 1.32%

Change: 2.91%

Change: 0.45%

Change: 3.09%

Data supplied by Profile Data

Change: 1.59%

Change: 0.47%

Change: 1.37%

Change: 0.00%

Change: 0.44%

Data supplied by Profile Data

Change: 0.23%

Change: -0.03%

Change: 0.06%

Change: 0.30%

Change: 0.00%

Data supplied by Profile Data

Change: 0.25%

Change: 0.31%

Change: 0.13%

Change: 0.36%

Change: -0.66%

Data supplied by Profile Data