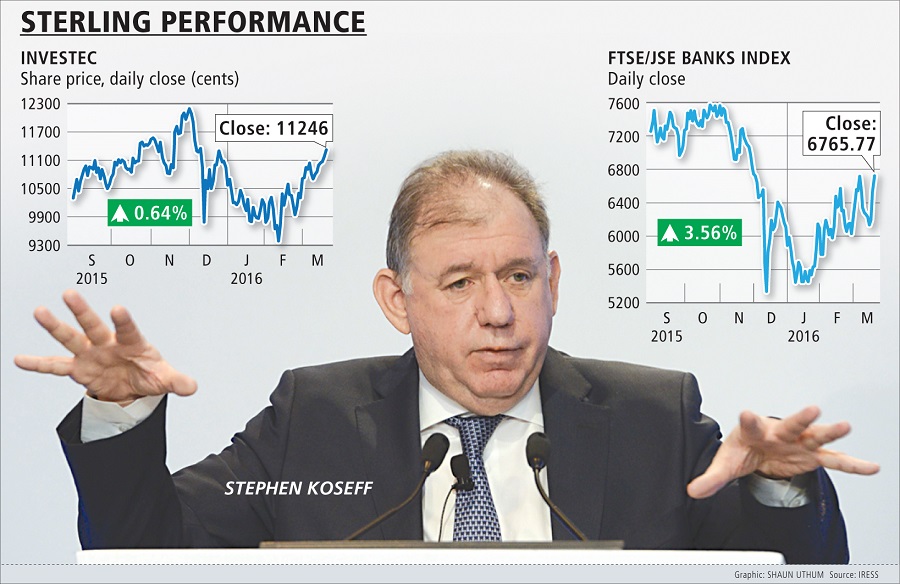

Investec profit strong in rand but slower in pounds

by Brendan Peacock,

2016-03-22 05:45:09.0

INVESTEC CEO Stephen Koseff delivered on Friday a mixed trading update before the close of the group’s financial year at the end of the month.

A 17% currency drop in the rand against the pound in the past 11 months has seen the group’s 2015 revenue grow in neutral currency terms, but it will be lower than the year before in pound terms.

Mr Koseff said Investec was comfortable contending with an adverse environment, but could not disregard a more volatile macro environment and looming regulatory headwinds.

Investec will, nevertheless record adjusted operating profit marginally ahead of the prior year in sterling, with a strong increase in rand terms.

Expenses in neutral currency terms will be slightly higher, mostly arising from the South African operations.

Investec had been spending on its digital platforms, due to launch in September, and to lure specialist investment and banking professionals, Mr Koseff said. It recorded healthy inflows into its wealth and asset management portfolios in the past year, with a high of 71%, slightly down from the year before (74%).

Investec has diversified and improved its sources and quality of funding, while the cost of funds has remained broadly stable. Investec had R252bn in cash or near-cash on its balance sheet, which was 40% of its liability base, Mr Koseff said.

A plus to its 2015 year is a drop in impairments on its UK legacy portfolio. Core loans and advances spiked 4% in sterling to £17.9bn, but 17% in neutral currency. Mr Koseff noted the unusual economic environment in which, for the first time in two decades, deposits exceeded loans in the market, given stimulus measures from developed markets and excess liquidity.

"Growth has been driven largely from mortgage loans to private clients and lending to high net worth clients, senior secured corporate loans and fund finance," Mr Koseff said.

Investec’s asset management business saw net inflows of £3.2bn to the end of February, with assets under management flat on a neutral currency basis, but slightly down in pounds.

The division’s momentum in SA had improved in the second half of the year in performance, flows from retail and institutional business, even though earnings have been affected negatively by market and currency movements, which should see it close the year slightly down on the 2014 results.

The wealth management unit saw positive net inflows of £1.2bn to the end of February, with a similar dip of 6% in funds under management in sterling, thanks to weak equity markets and asset price volatility. This may correct partially this month, given global market strength.

In specialist banking, Investec expects to post results comfortably ahead of the previous year, particularly from its UK division, with a rise of 17% in interest income in neutral currency; a rise in fees and commissions from the property business, in which it has been buying out minorities; and its Blue Strata acquisition, to be rebranded as Investec Import Solutions.

Stephen Koseff. Picture: MARTIN RHODES

INVESTEC CEO Stephen Koseff delivered on Friday a mixed trading update before the close of the group’s financial year at the end of the month.

A 17% currency drop in the rand against the pound in the past 11 months has seen the group’s 2015 revenue grow in neutral currency terms, but it will be lower than the year before in pound terms.

Mr Koseff said Investec was comfortable contending with an adverse environment, but could not disregard a more volatile macro environment and looming regulatory headwinds.

Investec will, nevertheless record adjusted operating profit marginally ahead of the prior year in sterling, with a strong increase in rand terms.

Expenses in neutral currency terms will be slightly higher, mostly arising from the South African operations.

Investec had been spending on its digital platforms, due to launch in September, and to lure specialist investment and banking professionals, Mr Koseff said. It recorded healthy inflows into its wealth and asset management portfolios in the past year, with a high of 71%, slightly down from the year before (74%).

Investec has diversified and improved its sources and quality of funding, while the cost of funds has remained broadly stable. Investec had R252bn in cash or near-cash on its balance sheet, which was 40% of its liability base, Mr Koseff said.

A plus to its 2015 year is a drop in impairments on its UK legacy portfolio. Core loans and advances spiked 4% in sterling to £17.9bn, but 17% in neutral currency. Mr Koseff noted the unusual economic environment in which, for the first time in two decades, deposits exceeded loans in the market, given stimulus measures from developed markets and excess liquidity.

"Growth has been driven largely from mortgage loans to private clients and lending to high net worth clients, senior secured corporate loans and fund finance," Mr Koseff said.

Investec’s asset management business saw net inflows of £3.2bn to the end of February, with assets under management flat on a neutral currency basis, but slightly down in pounds.

The division’s momentum in SA had improved in the second half of the year in performance, flows from retail and institutional business, even though earnings have been affected negatively by market and currency movements, which should see it close the year slightly down on the 2014 results.

The wealth management unit saw positive net inflows of £1.2bn to the end of February, with a similar dip of 6% in funds under management in sterling, thanks to weak equity markets and asset price volatility. This may correct partially this month, given global market strength.

In specialist banking, Investec expects to post results comfortably ahead of the previous year, particularly from its UK division, with a rise of 17% in interest income in neutral currency; a rise in fees and commissions from the property business, in which it has been buying out minorities; and its Blue Strata acquisition, to be rebranded as Investec Import Solutions.

Change: -1.27%

Change: -1.42%

Change: -1.87%

Change: -1.08%

Change: -2.01%

Data supplied by Profile Data

Change: -0.47%

Change: 0.61%

Change: -1.27%

Change: 0.00%

Change: 0.63%

Data supplied by Profile Data

Change: -0.12%

Change: -1.22%

Change: -0.17%

Change: 0.54%

Change: 0.00%

Data supplied by Profile Data

Change: -0.84%

Change: -1.85%

Change: -2.59%

Change: 0.36%

Change: -2.35%

Data supplied by Profile Data