Reserve Bank to monitor Barclays transaction for potential risks

by Staff Writer,

2016-03-02 14:31:51.0

SA’s main banking-sector regulator, the Reserve Bank, will closely monitor developments around Barclays plc’s reduction of its majority shareholding in the Barclays Africa Group Limited, to ensure that "any potential risks" from the transaction are mitigated.

Finance Minister Pravin Gordhan and Reserve Bank governor Lesetja Kganyago released a joint statement on Wednesday, giving the assurance.

One of many Reserve Bank tasks is to ensure stability in financial markets, and transactions such as the ones proposed by Barclays plc have a tendency to disrupt financial markets if not conducted in the right way.

Appropriate measures would be taken to manage capital flows arising from the transaction, the Treasury and the Reserve Bank said.

Barclays plc on Tuesday announced that it would reduce its 62.3% shareholding in Barclays Africa Group Limited over the coming two to three years.

Barclays plc CEO has been in regular contact with both the Treasury and the Reserve Bank in a "constructive and open" dialogue, the statement read. The Treasury and the Reserve Bank said Barclays plc had shown commitment to implement the new strategy in such a way that minimised the effect on the economies in which Barclays Africa Group Limited operated.

Barclays plc is reducing its shareholding mainly on a significantly reduced return on equity at group level, because of additional capital and other regulatory requirements, which the global bank needed to meet.

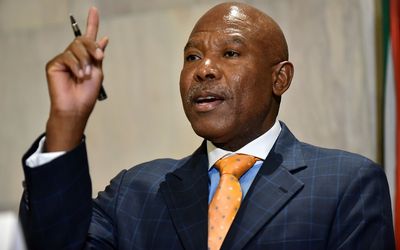

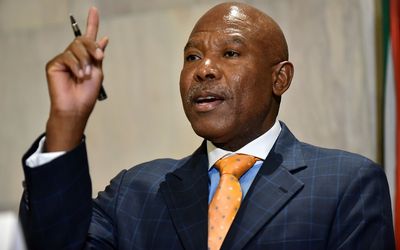

South African Reserve Bank governor Lesetja Kganyago announces the decision on interest rates in Pretoria on Thursday. Picture: PUXLEY MAKGATHO

SA’s main banking-sector regulator, the Reserve Bank, will closely monitor developments around Barclays plc’s reduction of its majority shareholding in the Barclays Africa Group Limited, to ensure that "any potential risks" from the transaction are mitigated.

Finance Minister Pravin Gordhan and Reserve Bank governor Lesetja Kganyago released a joint statement on Wednesday, giving the assurance.

One of many Reserve Bank tasks is to ensure stability in financial markets, and transactions such as the ones proposed by Barclays plc have a tendency to disrupt financial markets if not conducted in the right way.

Appropriate measures would be taken to manage capital flows arising from the transaction, the Treasury and the Reserve Bank said.

Barclays plc on Tuesday announced that it would reduce its 62.3% shareholding in Barclays Africa Group Limited over the coming two to three years.

Barclays plc CEO has been in regular contact with both the Treasury and the Reserve Bank in a "constructive and open" dialogue, the statement read. The Treasury and the Reserve Bank said Barclays plc had shown commitment to implement the new strategy in such a way that minimised the effect on the economies in which Barclays Africa Group Limited operated.

Barclays plc is reducing its shareholding mainly on a significantly reduced return on equity at group level, because of additional capital and other regulatory requirements, which the global bank needed to meet.

Change: 1.19%

Change: 1.36%

Change: 2.19%

Change: 1.49%

Change: -0.77%

Data supplied by Profile Data

Change: -0.08%

Change: 0.12%

Change: 1.19%

Change: 0.00%

Change: 0.10%

Data supplied by Profile Data

Change: 0.32%

Change: 0.40%

Change: 0.40%

Change: 0.22%

Change: 0.58%

Data supplied by Profile Data

Change: 0.09%

Change: -0.41%

Change: -0.13%

Change: -0.33%

Change: 0.10%

Data supplied by Profile Data